In the previous post in this series, we explored the idea that in order to effectively understand customer as buyer behaviour, we need to treat the customer as hero. Most of our customers start their relationship with us as buyers. Once an organization decides to buy our product or service, things change. The individuals within it become customers. Their organization moves from buying through implementing to operating. Creating ongoing customer success becomes the key to our future relationship with them. Let’s explore this transition and see why the buyer as hero framework is so useful for setting up ongoing customer success.

Jeffrey Moore, in his famous book “Crossing the Chasm”,

informed us that that customers behave differently at different stages of the innovation cycle. He based his work on Everett Roger’s seminal book on “The Diffusion of Innovation”, as well as many years of experience working with technology vendors and start ups.

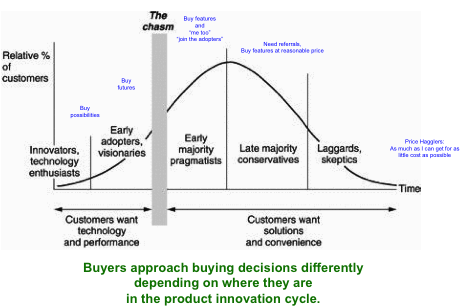

When you talk with customers, whether it is as a sales rep or as a customer success professional, it’s extremely important that you be aware of these customer dynamics. You have to adjust the questions you ask of your customer contacts and the understanding you form of what are hearing, based on this framework. Two extreme customer examples will help clarify this.

Price based decisions will be much more important to customer individuals and organizations who are laggards or sceptics – at the tail end of the innovation cycle. They tend to buy late in the innovation adoption cycle and act as price hagglers. Their implementation and usage concerns will be focused on how to get the most “operating bang” for the least number of operating “bucks”. For them, this will define customer success.

In contrast, innovation technology enthusiasts, who buy early in the innovation adoption cycle, are more concerned about what they can do with the product. They make buying decisions based on their desire to reach a future business outcome. As you interact with them, you need to keep in mind that their customer success will be all about future possibilities, what they can achieve with your product, rather than just cutting costs.

As a customer success professional or a sales rep, you are collecting customer intelligence in order to decrease blind spots that you have about your interaction with your customer. At the beginning of your relationship with a customer, you are selling to them for the first time. Your blind spots are going to be about your product features and your sales process. Once they choose your product or service, you are helping them succeed in their use of your of your product or service. You know that success will lead them to continue to buy your product or service over time. Your blind spots will be about your service relationship with them.

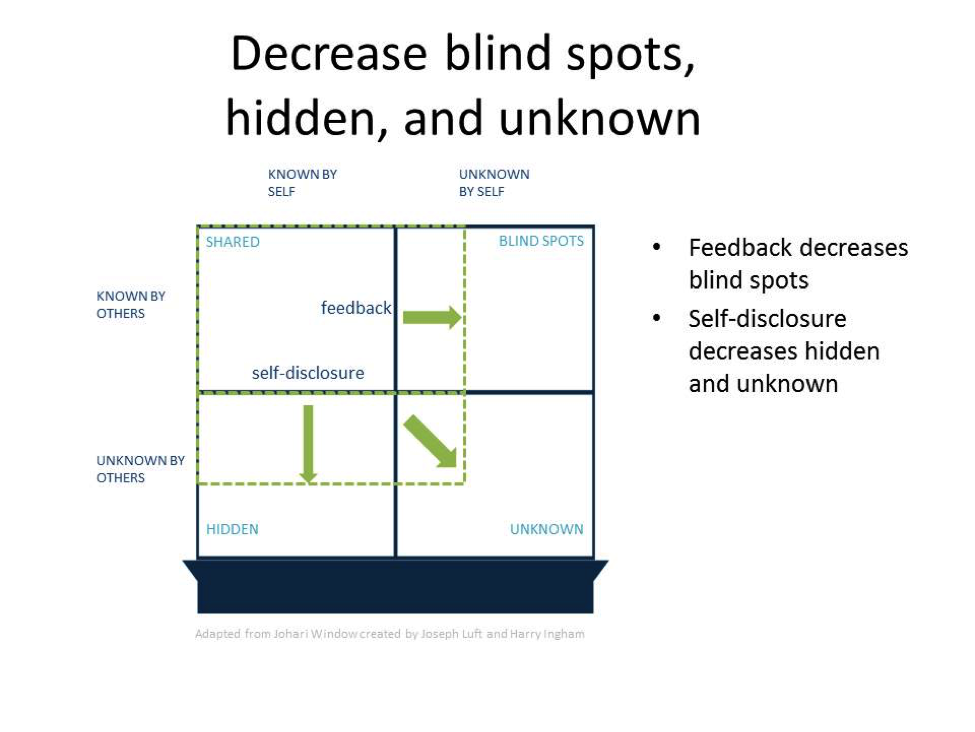

The Johari Window, depicted in the following schematic, allow us to understand the concept of blind spot with great clarity. In an individual context, feedback decreases a person’s blind spots. Self-disclosure increases what is known by the others around the person about the individual doing self-disclosure.

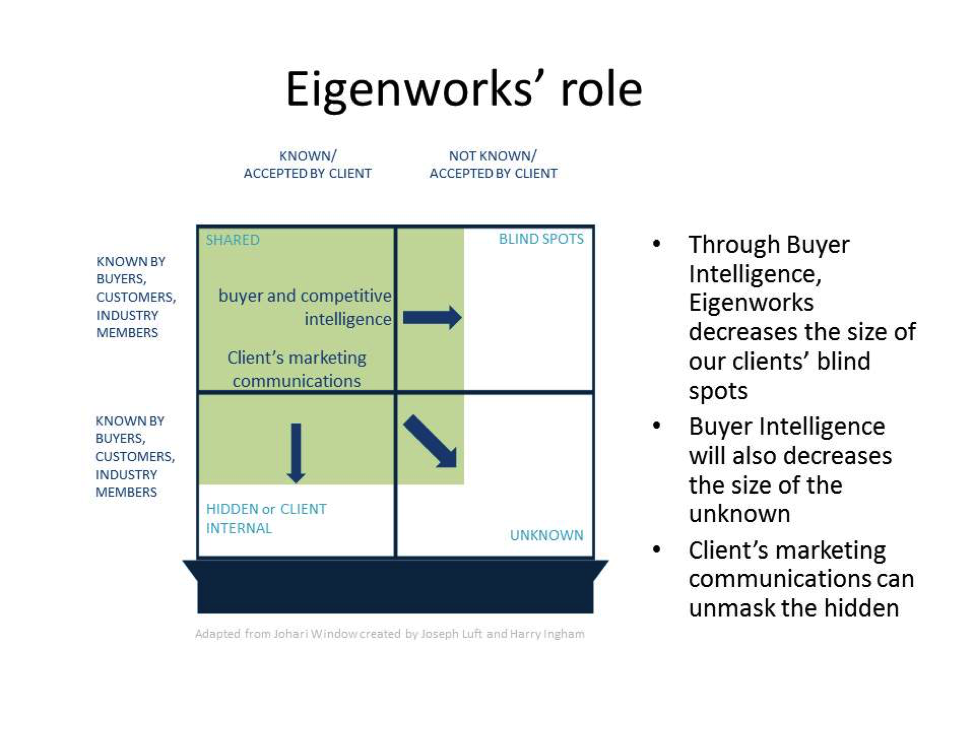

Organizations, particularly selling / customer servicing organizations have a similar Johari window. At the end of a competitive opportunity, a selling organization, whether it has won or lost, wants insight into the real reasons for the buying decisions, the reasons that occurred as part of the buyer’s internal journey as a buying hero. This information is part of the selling organization’s blind spot.

As a customer success organization, you want insight what the customer’s real challenges in using your product or service, so that you can help them achieve success with it. Customer and buyer intelligence information, appropriately collected and presented, can reduce these blind spots for your organization.

Getting a customer to tell you about the difficulties they are having as they strive for success using your product or service is usually easier than getting intelligence about why a customer bought or rejected your product or service in the first place. The members of both organizations are on a shared journey, where they are mutually dependent on another. As a result, they share a hero’s journey that leads to success for them as individuals, no matter for which organization they are working.

Your implementation teams work with customer staff on a daily basis to get your product or service up and running. Your customer success individuals interact with customer staff to problem solve their operating difficulties and provide them with access to best practices. The feedback you need to reduce your blind spots is generated during the course of your problem solving interaction with the individuals in the client organization.

Eliminating Win / Loss Blind Spots Through Buyer Intelligence

It is a different story when it comes to buyer intelligence. Truly eliminating blind spots about competitive wins and losses is a much more complicated business.

Most selling organizations do not have the in-house capability to collect the buyer intelligence which is necessary to decrease their selling behaviour blind spots. Selling organizations may have an internal competitive/buyer intelligence function. Generally, the work of the group is limited to collecting, collating, analyzing and reporting quantitative information about wins and losses. The individuals in these groups know what percentage of competitive opportunities that were won and lost. They may have access to their sales reps’ perceptions of the internal dynamics that those sales reps believed occurred when the prospect was making the buying decision. But as of been pointed out in the previous posts, this is only a surface level appreciation of the deep story about a buyer’s internal decision dynamics.

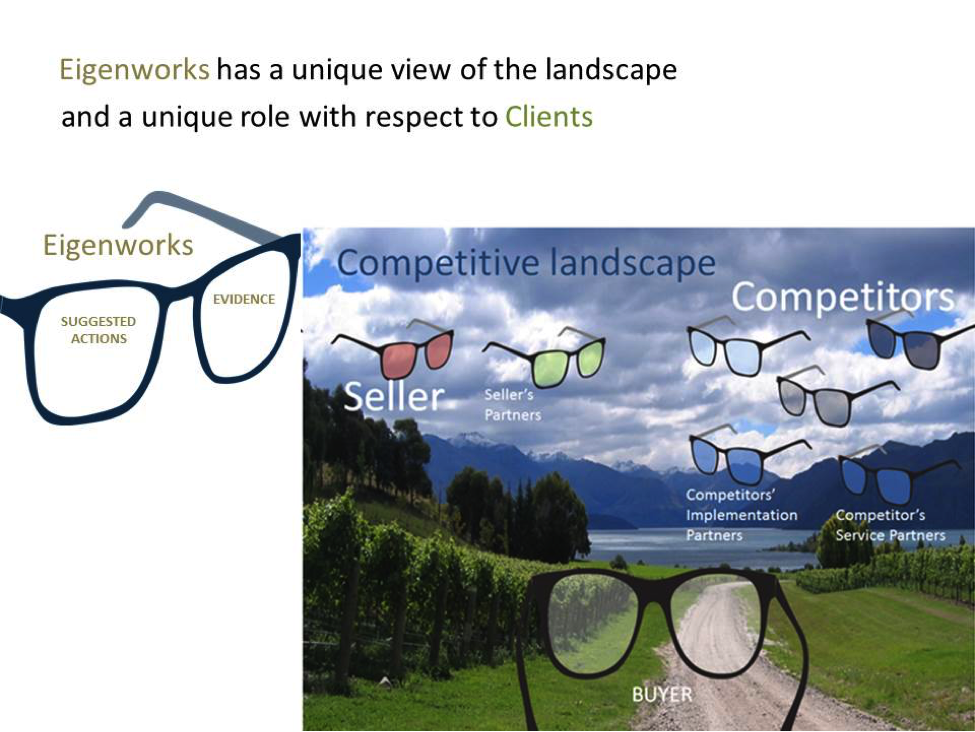

In any competitive landscape, the individuals in that landscape see what occurs through a set of lenses that reflect the way they participate in landscape. The buyer’s perception of the dynamics in any competitive landscape is shaped by the players in the landscape with whom they interact. The seller’s perception, (and the perception of the seller’s partners, if they are part of the selling process,) is impacted by their desire to successfully sell. Competitors’ views of the dynamics of the interaction during the competitive opportunity are similarly tinted by their win objectives in the situation.

To truly get insight into these landscape dynamics, and to really understand, the deep story behind the process that led to an organization’s buying decision, requires an independent point of view. The individual formulating the understanding of the dynamics in any competitive situation needs to stand outside the competitive landscape in order to be able to hear all of the nuances of what happened.

Such an “outside” perceiver is capable of seeing the patterns that develop when a series of interviews are done with a selling organization’s buyers. In the best of all possible worlds, those interviews span a focused set of buying decisions. They include representative wins, losses, renewals, and erosions. They are sharply focused around a specific product or service. They are timely in that the buyer sample includes recent buying decisions. When this is the case, patterns or themes emerge if the interviews are done carefully and appropriately recorded, transcribed, and analyzed.

The objective is to produce evidence which can be presented to the selling organization in a compelling fashion. These insights are not an “expert’s” personal opinion, based on that person’s past experience and preferences. The insights are supported by evidence collected systematically during a structured set of buyer intelligence interviews.

The interview / analyst brings her or his experience to the process of formulating them, but always does so in a way that must be supported by the evidence available in the interview transcripts. Such evidence-based consistent patterns or themes resonate deeply with decision makers in selling organizations. They provide a level of insight into the dynamics of a selling organization’s buying behaviour and competitive results that cannot be obtained in any other way.

It takes a carefully structured research process to accomplish this. It’s not just a matter of talking to a few people randomly. The process has to be carried out in such a way that gathers, organizes, analyzes and reports the evidence to the selling organization in in a way that leads to them accepting it as real and actionable. The way in which this information is collected and presented must create engagement at every level and every step of the process. Such engagement is crucial to a buyer intelligence project’s success. When such engagement is achieved, buyer intelligence insights lead to action – change – on the part of the selling organization that increases its selling success in the marketplace.

The third party buyer intelligence expert organization must create this engagement. Buyer intelligence projects must be managed in a way that demonstrates, on a day to day basis, that the individuals in this organization have the ability to listen and to respond to everyone’s concerns from day one. Selling organizations don’t believe that third party firms are capable of responding and understanding buyers unless the people in the research firm also show that they respond and understand the individuals in the selling firm (i.e. the third party firm’s client) on a day to day basis. This is an essential part of creating the needed creditability and engagement.

The third party buyer intelligence group must work with appropriate people in the selling organization to identify the competitive opportunities that need to be researched. These opportunities must balance two crucial needs. First, the opportunities studied must align with the objectives of the selling organization. But equally important, the total sample of opportunities must meet the data collection needs of the buyer intelligence organization. The selected sample must be structured in a way that allows the third-party intelligence group to form a complete picture of the buyers’ view of the dynamics of the competitive landscape. Only then can this information that lead to accurate insights. Collaboration between the client (the selling organization) and the researcher (the buyer intelligence expert firm) is the key.

An aside:

The members of the third-party buyer intelligence group are on their own hero’s journey. Their objective is to behave in a way which transfers the insights they gain through the buyer intelligence research process to the client organization. These insights must move from being “ours” (i.e. the researchers’) to “yours” (i.e. the key decision makers in the client organization).

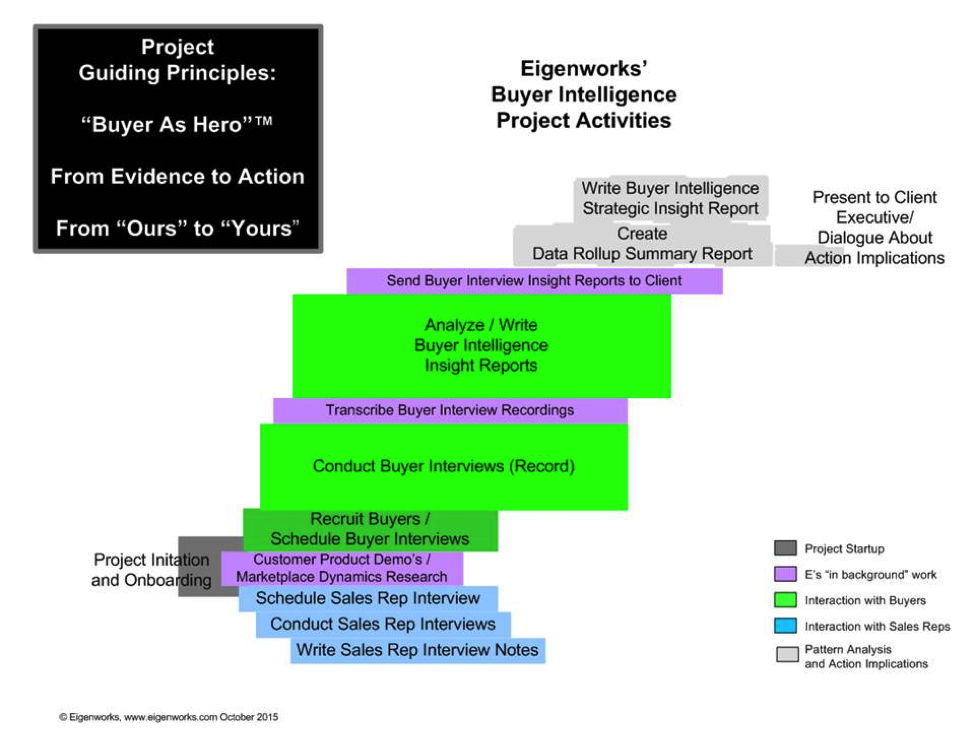

Buyer intelligence project have sequential, overlapping steps, some of which are absolutely essential, and some which are optional depending on the needs of the client organization.

The buyer intelligence research process depicted in this schematic is best in class. It is deeply infused by a commitment to treating the “buyer as hero”, as discussed in the previous posts in this series. When the individuals involved in carrying out these steps share an understanding and commitment to the “buyer as hero” approach to buyer intelligence, a profound qualitative change occurs.

The individuals who participate in this buyer intelligence research,

- the steps they take when interacting with interviewees and client individuals,

- the actions they share with interacting with one another,

- and the information they create as they do so,

all tap into the underlying, instinctive understanding of what it is to be a day-to-day organizational hero that Joseph Campbell has shown infuses all of our lives. The result is actionable insight for the selling organization that produces profound bottom line competitive results.

What Customer Success Professionals Learn From Best In Class Buyer Intelligence Best Practices

People have been talking about the need to listen to customers for years. But great listening is not enough. Creditability which leads to action is key. For buyer intelligence, this means evidence based insight. For customer success, this means problem solving with customer staff to implement success in ways that are relevant to their organization.

Accepting the client’s definition of their problems means understanding where they are on the innovation cycle. You may be working for an organization that is at one place in this cycle. Your customers may be at a very different one. You need to understand both, and bridge across any differences, in order to succeed in your customer success efforts with each of your clients.

Listening plus creditability creates engagement. Customer success is about constantly engaging in productive problem solving with your customers. The individuals in your customers need to act to experience the success that you are helping them achieve. This means moving them from “your suggestions” to “their actions”.

Your organization may start on a customer success journey with an effective buyer intelligence program, based on the best practices described above. But it will not end there. The skills and values essential to effective buyer intelligence:

- treating your customer as a hero on his or her specific organizational journey,

- and a dedication to basing your joint problem solving based on evidence based insights,

are as relevant to customer success professionals as they are to buyer intelligence experts.