Anyone who knows me knows that I’m an annoyingly-positive optimist. But like every CEO, I’m also constantly paranoid. So two narratives are constantly battling away in my brain right now:

- “The market opportunity for SaaS has never been better.”

- “The stock market is down by how much?”

After reading the 732nd memo from a VC firm with their thoughts on the downturn, I decided I needed to get the real scoop. So a couple of weeks ago, I sent out a survey to Private Equity and Venture Capital investors to see what’s on their minds. What guidance were they giving portfolio companies?

PE and VC Firms Are Aligned on Priorities

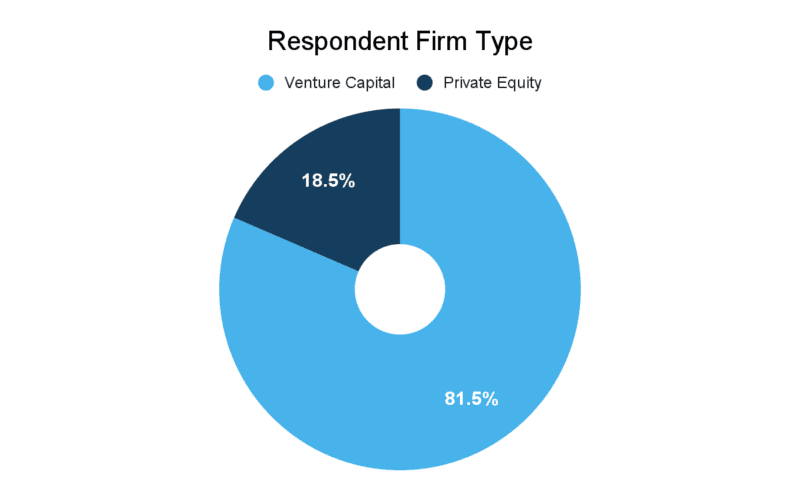

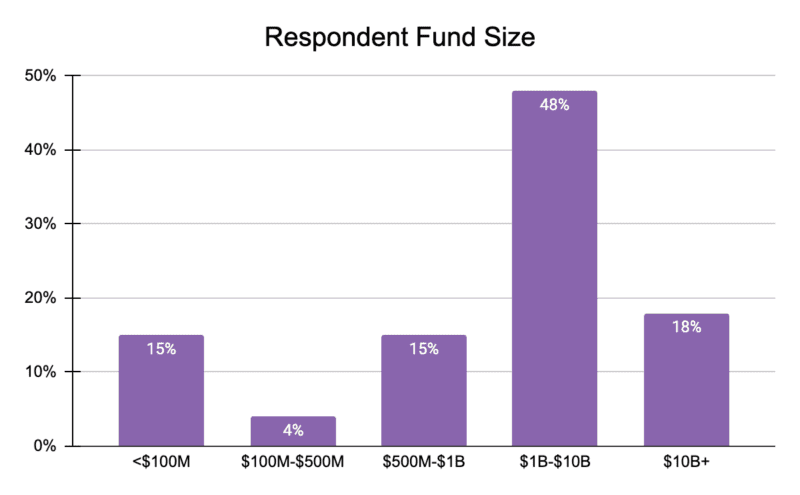

For respondents, I cast a broad net to look for themes across Private Equity and Venture Capital firms and across fund sizes from less than $100M to over $10B. The answers were pretty consistent. And with an over 20% response rate, the results gave me some confidence as well.

1. Efficient Growth, Gross Margins, and NRR Are Gaining Importance

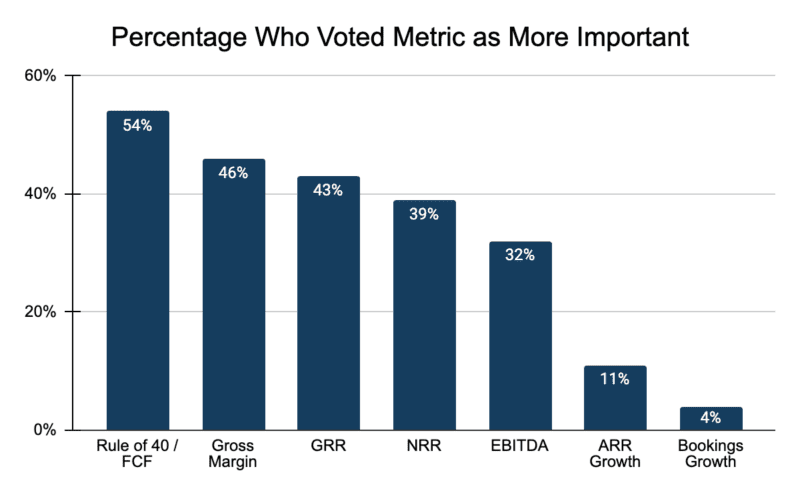

Respondents were asked to rank various SaaS metrics as either “More, Less, or of Equal Importance” given the economic downturn. Their responses were filtered down and the results below show what percentage of firms ranked a metric as more important.

As you can see, efficient growth, gross margins, and NRR are the topic of the day – much more so than total ARR growth, which likely would have been the winner during more “bubbly” times.

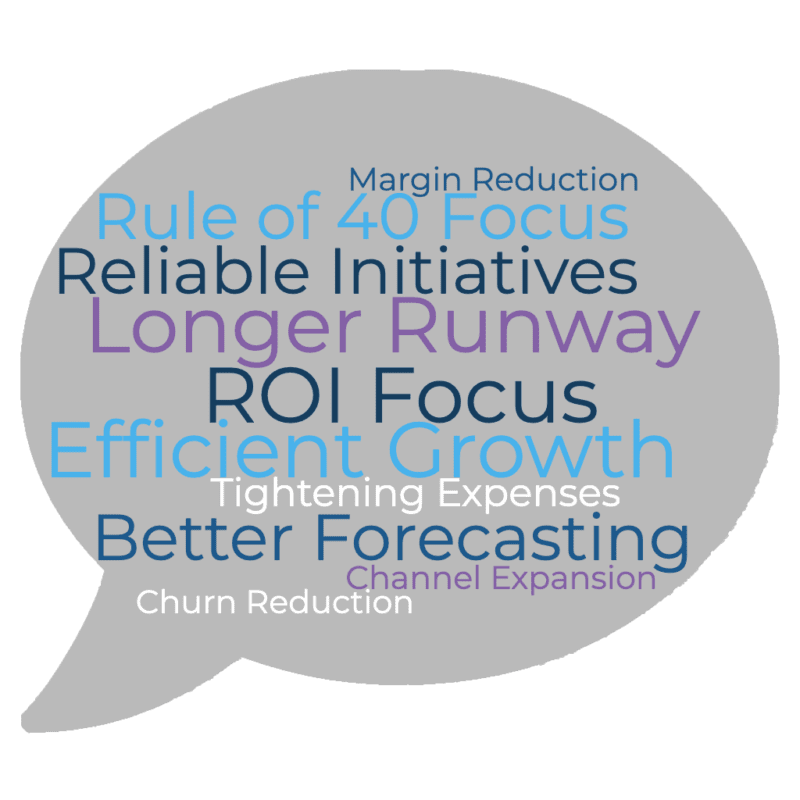

2. Investors Were Guiding Companies to Focus on Fast Payback on Initiatives

At the end of the survey, I asked several open-ended questions about initiative prioritization in their SaaS portfolios. What was the most common theme? Speed. They were guiding portfolio companies to prioritize initiatives that had fast payback – churn reduction, margin optimization, channel expansion – and defer initiatives that would take a long time to see ROI (e.g., international expansion).

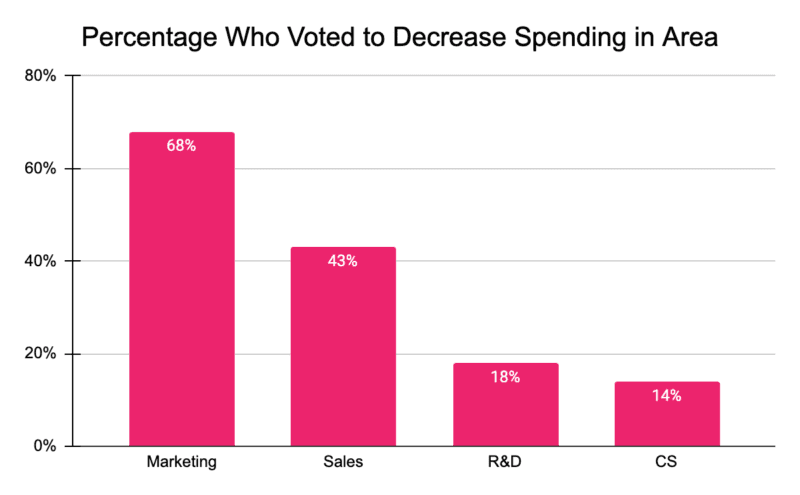

3. Investors Recommend Caution on Spending; Customer Success is The Least Likely Department to Get Cut

Then came the toughest question – where do investors think portfolio companies should increase and cut spending? No surprise but nearly every investor advocated for pausing or reducing spending in general. Sadly for our Marketing friends, Marketing budgets were the most impacted in this group. But optimistically for the CS world, CS budgets were the least likely to be cut. If this survey had been run a couple of years ago, I know CS, as a nascent group, would be the first to be cut. These survey results are proof about how far the industry has come.

In Conclusion

The next few years for SaaS are going to be tough. But what’s encouraging is how consistent the data is on how investors are thinking about focus areas:

- Improve growth efficiency by optimizing payback periods.

- Continue to optimize gross margins.

- Increase Net Retention through Customer Success and cross-sell.

As I’ll share next week, the data from polling VC and PE-backed CEOs was strikingly-similar. CEOs and investors being aligned? We do indeed live in strange times!

Learn More

Want all the juicy details from this survey? Check out the 2022 SaaS Market Report.