Adopting a Product Metrics Framework

A great metrics strategy should account for the unique qualities of your product and reflect broader business objectives. Popular product metrics frameworks such as AARRR and HEART can provide guidance here but ultimately fall short because they’re not tailored to your product and applying them directly without further consideration is risky.

AARRR, otherwise known as the pirate metrics, summarizes each step of the user journey as a conversion funnel, from acquisition all the way to revenue (see the table below)and is limiting for products with a non-linear user journey. Google’s research team developed the HEART product metrics framework which prioritizes user experience by including measures like happiness and task completion, but isn’t well suited for evaluating monetization strategies.

Overall, a great metrics strategy must not strictly adhere to one framework. Every product is different, there’s no one-size-fits-all solution, rather the key is to define metrics that will help you monitor your product and drive your specific business objectives.

In this article, you’ll learn about the underlying concepts behind these famous metric frameworks and how to apply them to your own context.

Summary of Key Product Metrics Framework Concepts

The table shows how the different categories of metrics in the AARRR (Acquisition, Activation, Retention, Referral, Revenue) and HEART (Happiness, Engagement, Adoption, Retention, Task Completion) product metrics frameworks map to key moments in the user lifecycle. By understanding the core concepts behind each category, you can more easily apply them to your own product based on the use case or area you are trying to improve.

| AARRR | HEART (not in order) | Customer Lifecycle Stage |

|---|---|---|

| Acquisition | User starts using the product | |

| Activation | Adoption, Task Completion | Perceives initial value |

| Retention | Retention, Engagement | Continues to realize ongoing value |

| Referral | Happiness | Advocates for the product to friends and colleagues |

| Revenue | Renews, upgrades or expands subscription or purchase |

Below we’ll explore each lifecycle stage and give some examples so you’re armed with the knowledge you need to define metrics that make sense for your business.

Understanding Different Metric Groups

Starts Using the Product

For SaaS-type products, there is likely a sign-up step where the user registers their basic details. Depending on your acquisition process an account might be able to login in and start using your product straightaway or you may grant access to the tool only after a series of sales calls. The key is to home in on the moment where a customer first starts using your product and quantify this with metrics such as unique signups, unique first logins or free trial starts.

Not only will these metrics help you monitor your sales and marketing efforts but they’re often used as the first step in a funnel and become the denominator of other metrics to evaluate what percentage of your new users reach milestones like trying a new feature or making a purchase.

Perceives Initial Value

This category of product metrics is all about defining key milestones for new users where they first perceive the core utility of your product. The most important milestone is often referred to as an “aha moment” and this moment can be used to define activation. This milestone is closely linked to your value proposition so naturally, it should be highly customized for your product.

If you already have user analytics implemented, you can look for correlation between different user actions and high retention. If not, as a starting point you can reflect on what problem your product solves and pick a moment where the typical user first perceives that value.

A SaaS product that helps interior designers share proposals to clients, might have milestones such as creating a vision board and sending it to the client. They could measure what percentage of new users do that within 7 days of signup. When measuring rates like these, it’s recommended to include a time component in the definition because your objective is to get users to that milestone in a reasonable window. For some products, this might be within the first session, for others it may take a week or even longer.

Alternatively, you could measure the average time it takes users to reach this milestone and focus on shortening this, this metric is often referred to as Time to Value (TTV).

These types of metrics will help you measure the success of your user onboarding strategy, which should be designed to drive users to the important milestones you’ve defined and might involve 1:1 touchpoints with dedicated customer success agents or a self-guided product tour.

|

Platform

|

Out-of-the-Box KPIs

|

Segmentation

|

Feature-Level Adoption & Retention Analysis

|

Cross-Channel User Engagements

|

Engagement Impact Analysis

|

A.I-Powered Product Feature Mapping

|

Mobile Application Support

|

|---|---|---|---|---|---|---|---|

|

Gainsight

|

✔

|

✔

|

✔

|

✔

|

✔

|

✔

|

✔

|

|

Heap

|

✔

|

✔

|

✔

|

✔

|

|||

|

Pendo

|

✔

|

✔

|

Continues to Realize Ongoing Value

Once a user perceives initial value from your product you need to measure whether or not they come back and use it again. Retaining users is much more cost-effective than acquiring new ones and crucial to the longevity of your business.

There are two key questions you need to answer to define your retention metric.

How do I define usage?

Similarly to figuring out your “aha moment”, reflect on what your core value proposition is. How you think about usage should be closely tied to that. For example, a social media scheduling tool would want to focus on users scheduling posts as their key action.

How often is my product used?

Try to be realistic when answering this question. Not all products are daily or even weekly use products and that is fine. There are plenty of examples of incredibly successful products that are used infrequently but keep people coming back, think about Airbnb or online marketplaces. However, if you’re providing B2B tools your usage is likely to be more frequent.

Assuming the social media scheduling tool mentioned previously is a weekly use product, you would then focus on measuring the percentage of users who came back to schedule posts on a weekly basis.

For SaaS products, it may be tempting to measure retention just based on subscription renewals. While this is important to measure, keep in mind that payment is not always the best predictor of continued satisfaction with a product. By the time a customer cancels their subscription, they likely already stopped getting value out of your product. Understanding whether or not a customer continues to get value from your product can help you intervene before it’s too late.

Advocates for the Product to Friends and Colleagues

At its core this category of metrics is about making the most of a satisfied customer to help you, onboard additional customers. In practice that can take on different forms. User-to-user referral programs in the B2C space are legendary. Dropbox and Uber have had incredible success growing their product by leveraging this strategy.

In a B2B context referrals might look a bit different. If you provide a professional tool you might want to measure how many users invite their colleagues to use it. For products that are intended to be adopted company-wide from the outset though this is less relevant as individuals may not have any choice in whether or not they use the product.

However, even if you don’t have an incentivized referral program you still want to understand whether your users are satisfied enough that they would recommend your product if the situation arises. In this case, you could choose a metric to evaluate their satisfaction, such as an NPS score or similar survey questions, which you can display to your users within your tool.

Renews, Upgrades or Expands

The metrics in this category will be highly dependent on your business’s revenue model. If your product has a subscription model, as many SaaS products do, you can look at metrics such as net retention revenue (NRR), lifetime value (LTV), and average revenue per user or per account in a B2B setting (ARPU and ARPA). If upselling customers is an important part of your revenue strategy you’ll also want to look at expansion revenue, or the number of accounts who upgraded their subscription package.

Alternatively, an e-commerce product may focus on total purchases and the percentage of new users who purchase. Depending on what products you sell, measuring repeat purchases will be more or less important. This illustrates the importance of tailoring your metrics strategy to your product.

Lastly, products that monetize through advertising will want to look at ad impressions and engagements to help understand the success of their ad inventory.

General Recommendations

Map Out Your Metrics Visually

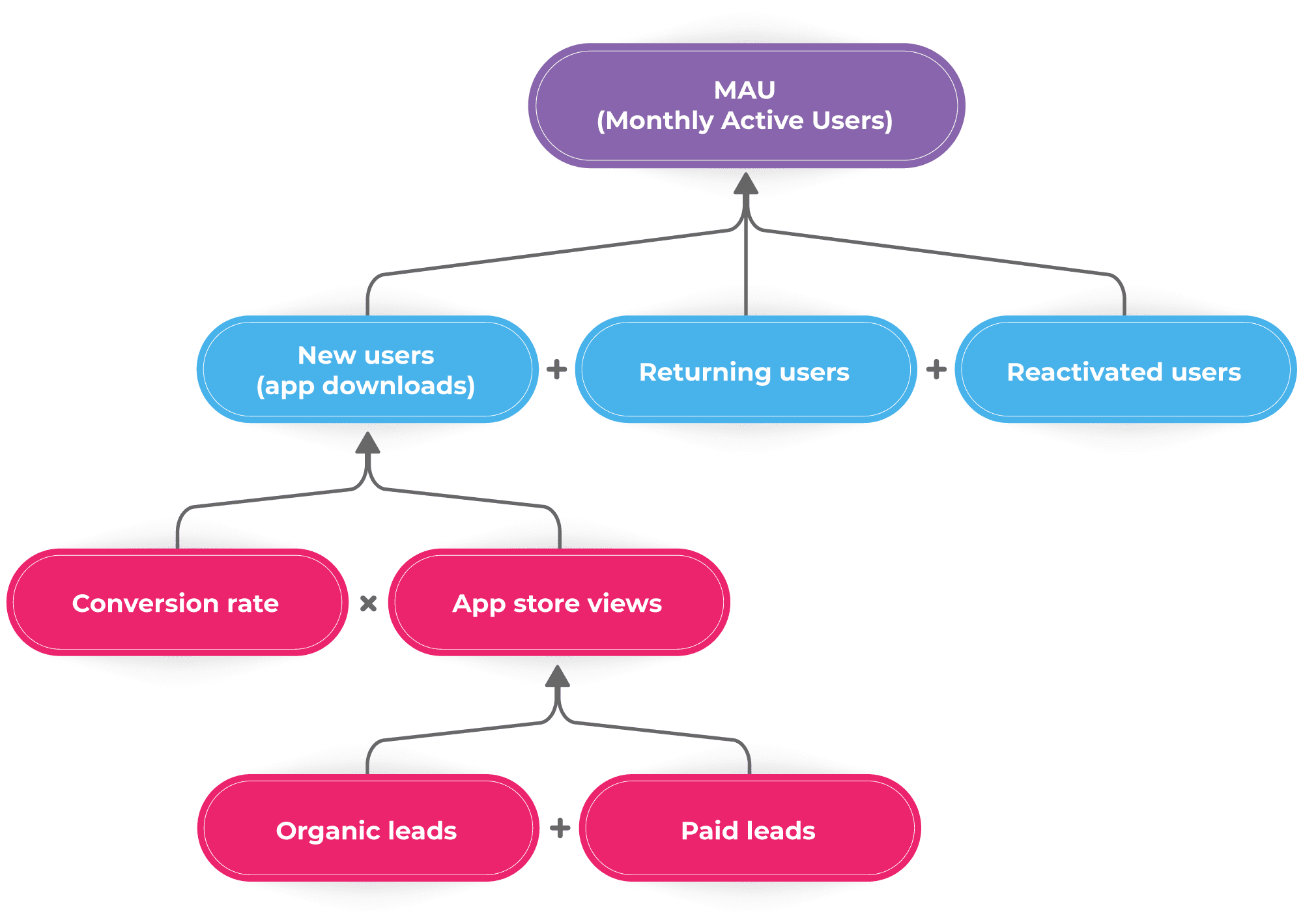

Defining a single metric for each category is a great starting point. It will provide you with a clear way to monitor the health of your product. However, four or five high-level metrics are often not enough to fully understand why you’re seeing the results that you’re seeing. You’ll likely find yourself looking at related secondary metrics. To avoid getting lost in a sea of numbers, it’s helpful to create a visual map or KPI tree that shows the hierarchy and relationship between primary and secondary metrics such as in the example shown below.

Example of a KPI tree (source)

This can also help different teams across the organization have ownership over metrics that are directly actionable for them, whilst still being aligned with high-level goals.

Make Sure to Include Both Leading and Lagging Metrics

Some metrics like retention and revenue represent the outcome of many other factors and they’re often lagging indicators. Think for example about a subscription product with a 30-day free trial. This month’s revenue figure includes subscribers that started their trial one month ago, and by the time you see the dollar amount, it’s too late for you to intervene and have an impact on the outcome. It’s important to find metrics that are leading indicators to help you with day-to-day decision-making. In this particular example, you could track the number of users starting a free trial.

Update Metrics Over Time

Defining a set of metrics for your product is not a set-it and forget-it task. As your product evolves and your business’s priorities shift, the metrics that you monitor should reflect these changes. They will also evolve because you will learn more about how users engage with your product over time. This will change your understanding of how certain metrics are related to each other and you should update your metric definitions using those learnings.

Conclusion

Product metrics frameworks exist to simplify metrics strategies and give you a basic outline to follow, but they’re often limited in their simplicity and don’t always apply to your particular product. The best thing to do is to learn from the intent behind these frameworks and use those ideas to define your custom set of metrics. The categories explained in this article should give you plenty of ideas to get started.

Remember that these metrics will likely evolve over time as you learn more about user behavior and business priorities shift. The most important thing is that these metrics are an up-to-date reflection of your business objectives.