This post was co-authored by Will Robins and Priyanka Srinivasan.

“If you can’t measure it, you can’t manage it.” -Peter Drucker

“It’s all about the Benjamins, baby.” -Puff Daddy

Whether you take your leadership lessons from Drucker or Diddy, you know that a huge part of the CEO’s job is to help your colleagues understand the “scoreboard” for measuring success.

Over the years, we, as leaders, have developed methods to quantify most aspects of business:

- Finance: GAAP (or IFRS) accounting rules

- Sales: Bookings methodologies

- Marketing: “Marketing Qualified Leads”

- Personal Ego: Twitter followers…

And so on.

And yet, with all of these statistics we still can’t measure what is usually the greatest “hidden” asset in our business—our customer base. How are we doing with clients? Are we delivering value for them? Are they likely to stay with us? Are they fans of us?

If you’ve studied the field, the Net Promoter Score was created to partially address these questions. But with the trend toward Digital Transformation, companies are awash in data about their clients that they could be using to measure client health.

Customer Health Scoring is the concept that you can integrate together various “signals” about your clients in order to quantify your customer base.

In this post, I will:

- Convince you that this is a CEO-level problem that will benefit ALL departments (not just the Customer Success department, if you have one)

- Show you how to approach building a Customer Health Scoring framework

- Most importantly, point out what mistakes to avoid

Why Measure Customers

As with other areas of measurement, I’d break the value of quantifying your customers into three conceptual buckets. I’ve drawn an analogy to Sales in the below table.

| Value | Sales | Customers |

|---|---|---|

| Report | Report on trend of overall bookings and pipeline to the company, board and investors | Report on trend of overall Customer Health Scores to the company, board and investors |

| Incent | Incent sales reps with commission based upon bookings | Incent team members managing clients (e.g., Customer Success Managers, Account Managers) toward growth in Customer Health Scores |

| Act | Take action on individual “deals” in the pipeline to convert them to bookings | Take action on customers where you can improve Customer Health Scores in some way |

What(s) To Measure

Did you pay attention in the last section? Something weird jump out? Did you notice I said “Customer Health ScoreS,” not “Customer Health Score?”

One of the biggest mistakes companies make when implementing Customer Health Scoring is thinking everything can be distilled down to one number.

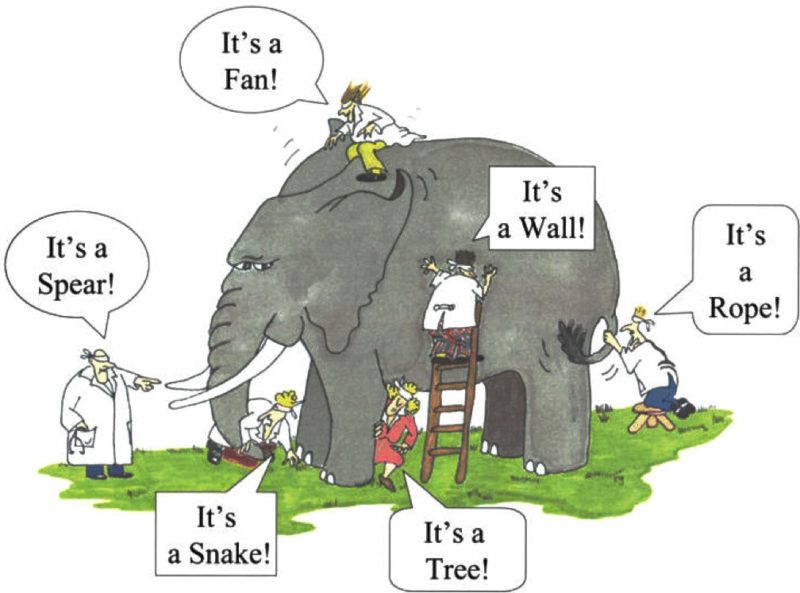

One way to think about it is to consider the story of the Blind Men and the Elephant.

Source: http://68.media.tumblr.com/tumblr_m59kgnTbUJ1qfvq9bo2_r1_1280.jpg

Customer Health is the “elephant.” But there are many views into health, and each is like one of the men grasping at the elephant. In our clients, I see seven common types of views into Customer Health:

- Vendor Outcomes

- Vendor Risk

- Vendor Expansion

- Client Outcomes

- Client Experience

- Client Engagement

- Client Maturity

Different organizations start with varying subsets of the above Scorecards:

- Want to track the overall ROI of Customers Success => Vendor Outcomes

- Want to have an early warning on risk in accounts => Vendor Risk

- Sales team driving Customer Success => Vendor Expansion

- Want to more closely track your impact to customers => Client Outcomes

- Voice of the Customer team driving Customer Success => Client Experience

- Marketing team driving Customer Success => Client Engagement

- Company effort to get clients at higher levels of sophistication => Client Maturity

Vendor Outcomes Scorecards

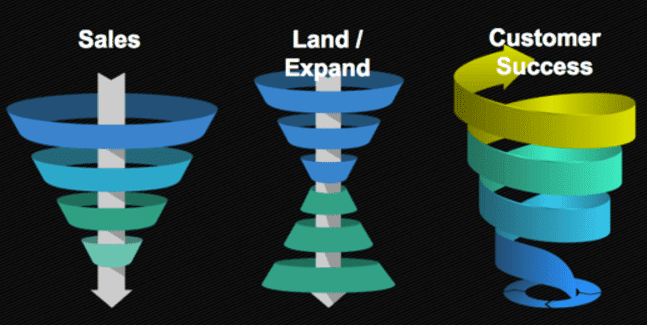

Clients provide multiple areas of value to vendors, and you should measure these separately. We wrote recently about this in our CRO’s Guide to Customer Success where we introduced the Revenue Helix.

For a typical vendor, the desired outcomes for the vendor include:

- Value if the client stays with them

- Incremental value if the client expands with them

- Incremental value if the client helps the vendor acquire new clients (e.g., as a reference)

So a Vendor Outcomes Scorecard could have the following top-level dimensions:

- Retention: Are they likely to stay with us?

- Expansion: Are they likely to expand in spend or consumption with us?

- Advocacy: Are they likely to be an advocate for us?

And here’s the confounding thing that you know if you’ve managed clients for a long time:

Clients can be guaranteed to stay with you near-term (because they are stuck) AND be a negative advocate (a Detractor). Clients can be engineering you out long-term (not “sticky”) AND short-term be planning to expand. Clients can be about to churn (Retention Risk) AND be an Advocate! It’s important to separate out the various “outputs” of a client relationship into separate metrics.

As an example, see the sample Vendor Outcomes scorecard below. We’ve created “groups” for Retention, Expansion and Advocacy, with sample indicators for each:

- Retention Indicators

- Adoption Sophistication Score: Number of advanced capabilities used.

- Support Health Score: Presence or lack of recent poor support experiences.

- Sponsor Score: Relationship with exec sponsor.

- Expansion Indicators

- Marketing Engagement Score: Attendance to recent marketing events.

- Open Opportunities Score: Presence of open sales opportunities in CRM.

- Utilization Score: Percentage of contracted products or services used.

- Advocacy Indicators

- Sentiment Score: Recent survey feedback.

- Reference Score: Recent reference activity.

- Community Score: Activity in online community.

In general, Vendor-centric Scorecards are the types you’d want to share internally or with your board (or your CFO!)

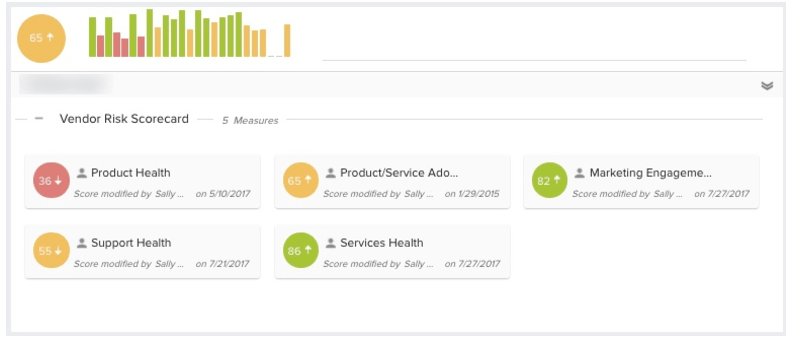

Vendor Risk Scorecards

Pivoting a different way, some companies may want to measure client risk by functional owner—so you can define clear accountability by department. We defined a strawman of this a few years ago with our Risk Framework. Examples could include:

- Support Health: Does the client have too many cases open? Repeated cases? Cases aging too long? This could be owned by the head of support.

- Product Health: Does the client have open bugs or critical enhancement requests? Similarly, the head of product would be responsible for this score.

- Marketing Engagement Health: Is the client engaged in vendor marketing activities? The marketing leader would be accountable here.

- Product/Service Adoption Health: Is the client using the vendor’s product/service actively and well? Often, the Customer Success team would directly drive this.

- Services Health: Have the client’s services projects with the vendor gone well (on time, on budget, on quality, etc.)? A head of Professional Services might take this on.

- And so on

Vendor Expansion Scorecard

On the positive side, some companies want to easily expose opportunity—or “white space” for their sales team.

You can imagine taking each product/service area and using logic to define the unsold opportunity to sell that offering into the given customer.

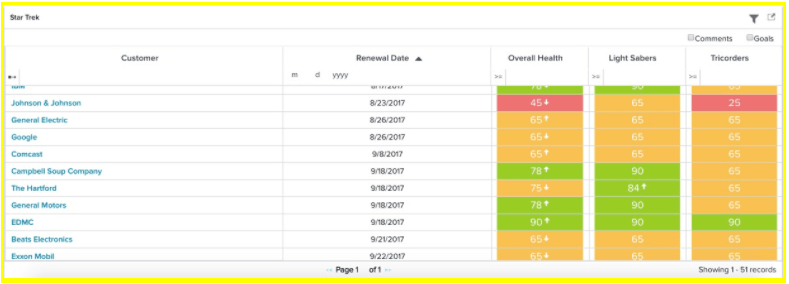

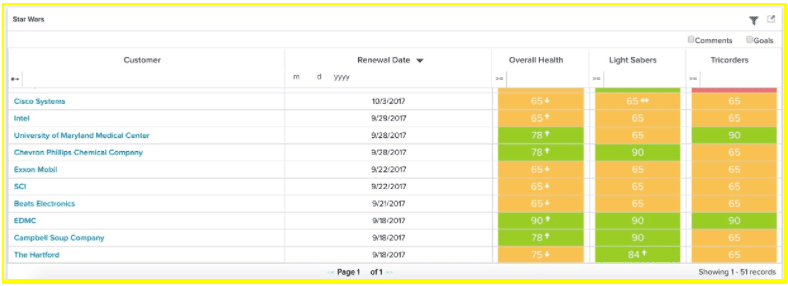

For example, imagine you have two product lines:

- Lightsabers

- Tricorders

You could define rules for what you expect a client to purchase:

- If Industry = “Star Wars”

- For Lightsabers

- GREEN = 10+

- YELLOW = 1-9

- RED = 0

- For Tricorders

- GREEN = 2

- YELLOW = 1

- RED = 0

- For Lightsabers

- If Industry = “Star Trek”

- For Lightsabers

- GREEN = 2

- YELLOW = 1

- RED = 0

- For Tricorders

- GREEN = 10+

- YELLOW = 1-9

- RED = 0

- For Lightsabers

You could have further overrides based upon health. If a client has risk issues in a given product, the expansion score for that product could be set to “NA” until the issues are resolved.

You can then put a very sales-friendly view in front of your reps of the “selling opportunity” in their accounts:

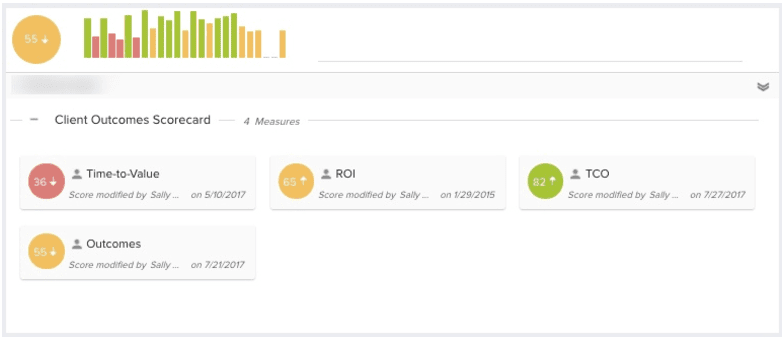

Client Outcomes Scorecards

Conversely, you could imagine putting yourself in the shoes of your clients and asking how THEY measure the success of the relationship. This could include:

- ROI: Has the client received and observed a Return on Investment?

- TCO: How much time and cost has been put in by the client (Total Cost of Ownership)?

- Outcomes: Beyond ROI, what other outcomes did the client achieve?

- Time-to-value: How long did it take?

But how do you measure these, you may ask?

Some products or services are marvelous in that they inherently drive quantitative ROI. Billing services can automate a calculation of “Dollars Billed” or “Collections Driven.” Energy companies can compute “Efficiency Gained.”

But for most companies, Client Outcomes Scorecards are likely to be part of a Success Planning process. This likely involves:

- Defining a client’s desired goals (ROI, TCO, Outcomes, etc.) during the sales process

- Capturing these (e.g., in a Success Plan)

- Handing them through the lifecycle (Pre-sales to Onboarding to CSM/AM)

- Reviewing and scoring them in regular Executive Business Reviews or via Surveys

This exercise is simple: What would you genuinely share with a client in a Quarterly Business Review? And the results should be mutually agreed to with the client.

An example of a Client Outcomes Scorecard is below.

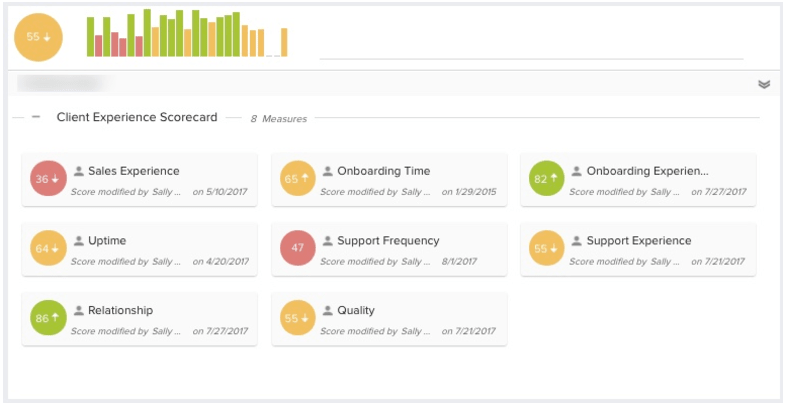

Client Experience Scorecards

But it’s not JUST about the Outcomes. It’s also about how you make a client “feel.”

To envision a Client Experience Scorecard, think about all of the “bumps” in a typical client experience:

- Poor expectation setting in sales

- Long onboarding

- Rocky onboarding experience

- Bad support experience

- Repeated support experiences

- Outages

- Weak relationship with account team

- Product/service quality issues

A sample Client Experience Scorecard might look like the following:

- Sales Experience: Survey client after sale to see how rep did in expectation setting.

- Onboarding Time: Measure actual onboarding time versus promised.

- Onboarding Experience: Survey client after onboarding.

- Support Experience: Survey client after cases.

- Support Frequency: Measure frequency of tickets.

- Uptime: Measure service uptime for client.

- Relationship: Regular Net Promoter Score survey.

- Quality: Count of bugs affecting client.

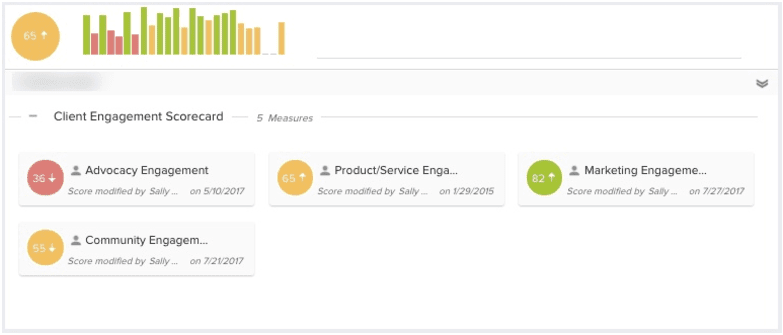

Client Engagement Scorecards

For many organizations, the focus on Customer Health is managing “leading indicators.” Often, the leading indicators for customer retention and expansion tend to be around the level of engagement between the client and the vendor.

A Client Engagement Scorecard might include:

- Product/Service Engagement: How sophisticated is the client’s usage of the product/service in question?

- Marketing Engagement: How often does the customer attend webinars, events, etc?

- Community Engagement: Is the client active in the vendor’s online community?

- Advocacy Engagement: Is the client an active advocate for the vendor?

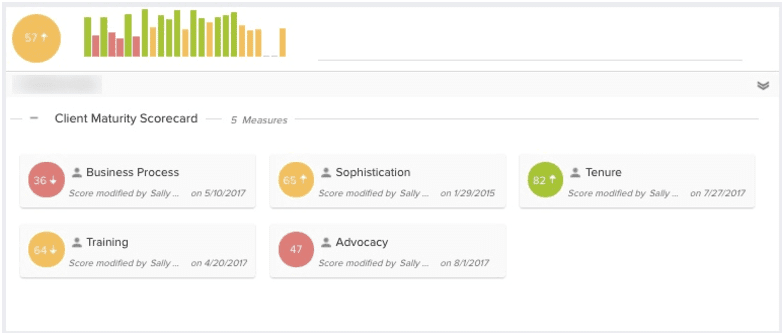

Client Maturity Scorecards

Some businesses, particularly “high touch” ones, want to drive clients toward increasing levels of “maturity” with their product or service. At the same time, they want to assess and staff clients differently based upon that maturity level.

A Client Maturity Scorecard could include:

- Business Processes: Does the client have business processes implemented around the vendor’s product or service?

- Sophistication: How sophisticated is the client’s usage of the vendor’s product or service?

- Tenure: How long has the client been using the vendor’s product or service?

- Training: How many people at the client have been trained on the vendor’s product or service?

- Advocacy: Is the client an active advocate for the vendor?

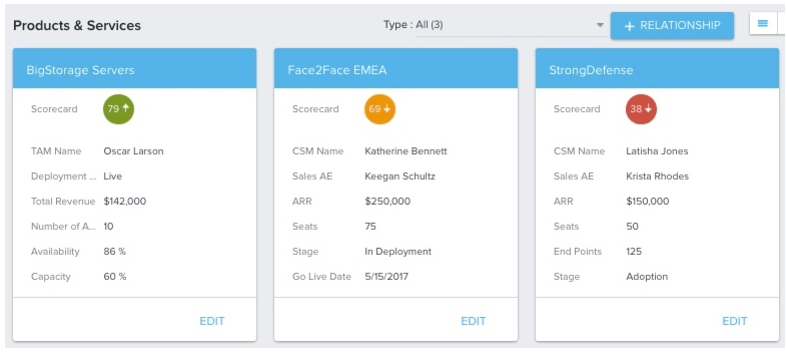

What (Parts of) Clients To Measure

Continuing the theme, if you have large customers and/or multiple products, it gets even more complicated. You may have a “sticky” relationship with one business unit and be about to churn another. You may have an Advocate in one business unit and a Detractor in another.

Similarly, a client may be about to churn one product line with you and be in the process of expanding on another.

Make sure you measure client health at a granular level—the same level at which your client is measuring you!

Where To Get the Data

Prediction: you’re going to spend the most time and energy as a company on the easiest problem. You’ll spend months and quarters of precious time talking about how your “data isn’t clean” and waiting until you “figure out your data.” In fact, you’re reading this post right now thinking “Nick, we’re not like the typical company—our data is a mess.”

Without knowing anything about your business, I can tell you that you have enough data to start. You likely have some combination of:

- Sales data in a Salesforce Automation (sometimes called CRM) system

- Financial data in an Enterprise Resource Planning (ERP) system

- Customer feedback data in a Survey system

- Services project data in a Professional Services Automation system

- Marketing engagement data in Marketing Automation system

- User engagement data in a Community system

- General customer data a in Data Warehouse

- Website activity data in a Marketing Analytics system

- Support data in a Support Ticketing system

If you’re lucky, you may also have Product Telemetry of some kind.

Now, if you have none of those, stop reading this post and go get yourself some data! But if you’re like most companies with a bunch of the above but with issues in quality, you’re not alone. Just from the most readily available of the data sources we listed, you can make progress on Customer Health Scoring.

How To Define Your Scores

This is the hard part. Now that you have the data and your objectives, you need to turn the former into the latter. Below are some principles to get started:

- Define Customer Health Scorecards, Not Scorecard: Per the previous section, define multiple ways of measuring client health. The beauty is you don’t have to choose! You can mix and match the same atomic data points (e.g., usage, NPS) into these separate views on client health.

- Define Scorecards At the Level Your Clients Experience: Per the previous section, whether your clients buy at the business unit level or at the product line level (or both), make your scores equally granular.

- Distinguish Leading Indicators from Lagging Indicators: It’s okay to have Scorecards that track both leading indicators (e.g., how engaged is the client in marketing) and lagging indicators (e.g., renewal forecast). But don’t average them together and expect meaning.

- For Each Scorecard, Mix and Match Data: For example, your Marketing Engagement Scorecard might include a measurement of their attendance to webinars (from your Webinar system), their open rate on emails (from your Marketing Automation system), and their registration for in-person events (from your Event Management system).

- Automate Wherever Possible: Manual inputs on Customer Health (e.g. a CSM’s subjective perspective/scoring on customer sentiment) are sometimes necessary, but such inputs create more process for CSMs and are seldom objective. Pull in hard data from sources (see above) wherever possible to minimize subjectivity and the need for CSMs to make time-consuming inputs.

- Define An Understandable Grading Scheme: While eventually a numeric system (0-100) may be appropriate for visualizing a trend, you may want “bands.” We recommend color bands for intuitive understanding (e.g., Red/Yellow/Green).

- Leverage Trends But Be Careful: You may want to look at “changes” to measure health (e.g., a client dropping in usage could be a bad sign), but you need to watch out for “false positives” (e.g., a usage drop due to vacations).

- Look for “Absence of Data”: One of the most powerful signals you can look for is the negative. Which clients haven’t attended an event or webinar recently? Which clients didn’t open the roadmap release email nor attend the roadmap webcast? Which Decision Maker didn’t respond to your NPS survey?

- Vary Rules by Customer Segment or Maturity: Boaz Maor wrote about this recently. You can’t treat all customers the same in terms of measurement. Make sure you are defining rules based upon the unique segments of your business.

- Leverage Benchmarking Where Appropriate: If you have a common value (e.g., transactions/day) across clients, you can use benchmarking rules to compare a given client against the average or median of its peers—and then score based upon this benchmark.

- Use Overrides (But Sparingly): While you may normally take a combination of measures to determine a score (e.g., a combination of webinar attendance, event attendance and open rate to define Marketing Engagement), you may need an “override” in cases where, no matter what the other measures say, a selected variable trumps all others. For example, if you get a Detractor NPS response from an Executive Decision Maker, that may trump all other objective data. That being said, don’t have too many overrides or your scoring system will be for naught.

- Focus on Actionability: A big part of driving Customer Success as a company is identifying early signs. But equally important is finding ACTIONABLE early signs. A client that stopped using your service is interesting but what do you do about it? Perhaps more interesting is a client who is actively using your service but not reading your release notes. Near-term, they are healthy. Long-term, they may not perceive your innovation and may leave you. And you can do something about it.

- Don’t Have Too Many Measures: While I gave you many examples here, don’t overwhelm your team with too many scoring measures overnight. Start with a few (I’ve seen 6-12 work).

- Use Comments But Keep Them Important: Comments in a Scorecard can help provide context for the “why” behind a score. For example, “Support Health is RED because client has five open tickets.” But don’t overdo it.

- Keep Old Scores: While you may decide to change the rules in terms of how you measure an area, I encourage you to retain the old data. Hide it, for sure, to not confuse your team. But keep the old data as it may come in handy down the road.

How Not To Do It

These are pretty much the inverse of the above, but just for completeness:

- Don’t Average Averages: Don’t take all of your data about all aspects of customers, average them together, and expect meaning out of it. Same with averaging data across products and business units within a client. You wouldn’t average your Balance Sheet and Income Statement together and expect useful information, would you?

- Don’t Practice False Precision: I like color coding because numbers sometimes lead you to a false sense of confidence about how much you know. 87/100 health going to 86 is likely noise.

- Don’t Overdo Trending: If you want “RED” every time a client drops 10% in some metric, you will see a lot of (FALSE) red.

- Don’t Wait for Perfection: The beauty of having multiple scorecards is that you can start now and keep adding incrementally.

Next Steps

So what to do next? If I were you, I’d parallel process:

- Run an off-site with your team to define a “roadmap” for how to measure different parts of your client base.

- In parallel, pick one of the concepts in this article and get going so you have a starting point.

One final thought: let’s circle back to the “elephant in the room.” The elephant in this blog post is technology—specifically software. I’ve intentionally tried to keep this post completely agnostic vis a vis software, but if you’ve read this far, you probably understand that measuring your customer base according to the framework I’ve laid out is completely impossible without some sort of software solution.

Some companies choose to do this through a patchwork of tools (and lots of spreadsheets). Others look to all-in-one platforms or home-built solutions. As the CEO of a Customer Success software company, you might be surprised to find out that I don’t actually recommend Gainsight to every company—even though I am wholly convinced we’re the most sophisticated and full-featured offering in this category.

No matter what size or stage your company is in, the last step (and a crucial part of each prong of the parallel process I talked about above) is a software evaluation. I’ve written two resources that can help you assess your current situation and plan for implementing the best possible solution. I highly recommend you look at these regardless of which stage you’re at in your process:

- The Essential Guide to Choosing a Customer Success Solution

- The Buyer’s Guide to Customer Success Solutions

Most businesses say “our customers are our greatest asset.” And yet, those same companies have no way to measure said asset. It’s time to fix that.