This post was co-authored by Jake Wirfel.

It’s no secret that happy customers drive better business outcomes. But how much better? Gainsight has long been a leader in understanding how critical Customer Success is to the health of SaaS companies. The latest data shows that this relationship might be stronger than ever.

How to Measure Customer Success?

Historically, one of the most straightforward and commonly used metrics for measuring Customer Success was a company’s customer churn rate. The issue with churn is that it fails to capture the impact of existing customers who choose to upgrade or expand their use of a company’s product over time.

Let’s look at a brief example. Imagine I run a SaaS company—CloudCo—and my revenue is split equally across 10 customers. At the end of the year, one customer decides to switch to one of my competitors, while the other nine are so pleased with CloudCo that they double their business with me. A simple churn metric would suggest I am losing 10% of my business each year. However, examining the data differently, my happiest customers actually drove 80% year-over-year growth among my existing customer base!

This brings us to the Net Retention Rate (NRR). NRR solves the above problem by capturing the impact of a company’s customers growing their spend on its products over time. Quantitatively, this is done by looking at a single pool of existing customers and calculating their cumulative spending at the end of a period divided by their spend at the beginning of that period. In short, NRR tracks how much your existing customers want to spend with you next year as compared to this year.

As companies move from “defense” to “offense” in their Customer Success strategies, they shift their scoreboard from Gross Retention Rate and churn to Net Retention Rate.

Why does NRR matter?

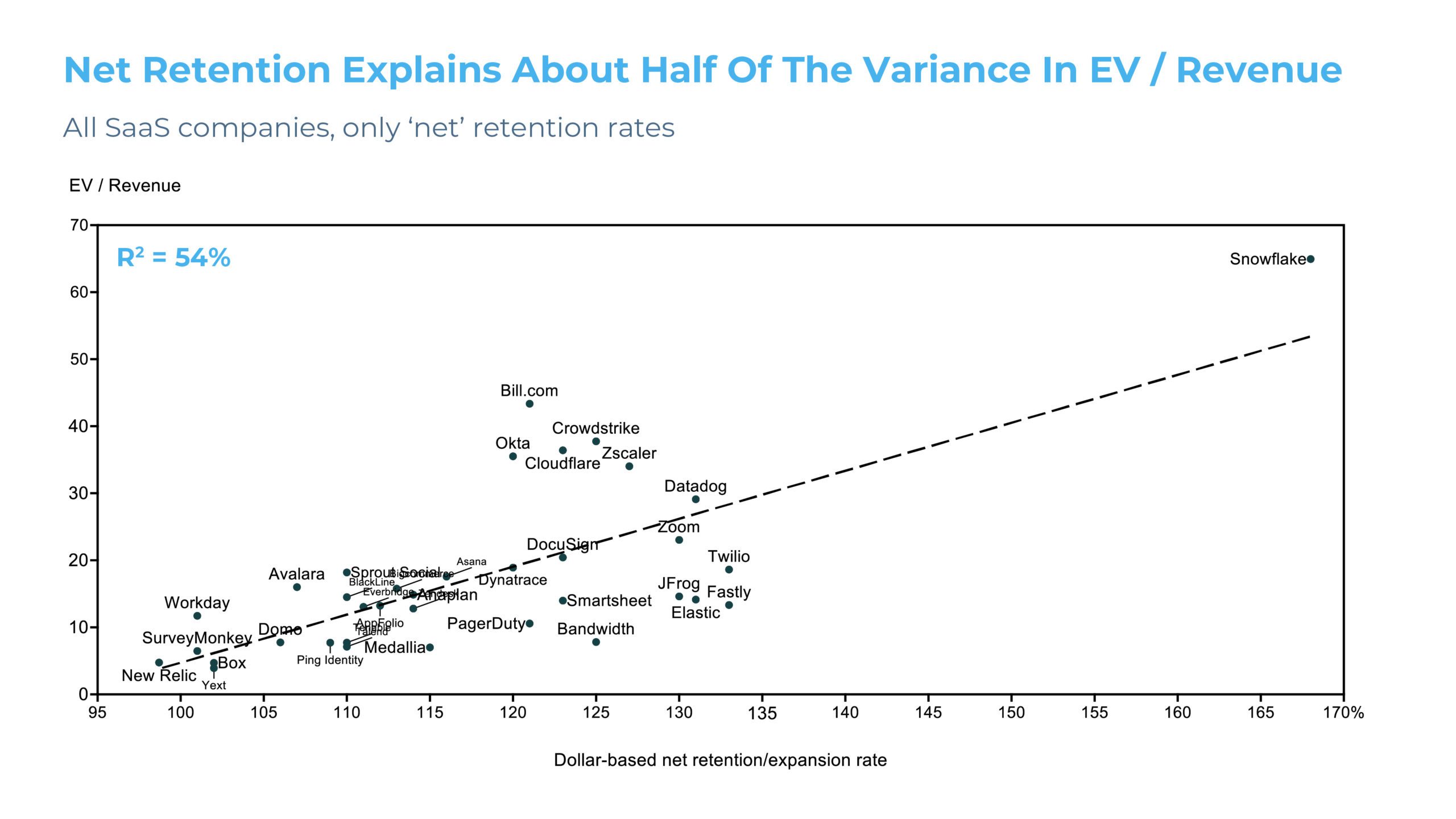

NRR measures the health of a company’s customer base. As such, it helps drive a number of a company’s most important financial and business metrics. To illustrate this, we analyzed the constituent companies of the Bessemer Venture Partners’ Cloud Index that report net retention metrics to understand their relationship with revenue multiples* (EV / Revenue.)

The results, shown below, indicate a clear positive relationship between a company’s NRR and EV / Revenue ratio. The regression coefficient of 0.72% suggests that each percentage point increase in NRR is associated with a ~0.7x change in a company’s revenue multiple. This means that for a $1B revenue SaaS company, a mere 1% increase in NRR could translate into more than $700M in enterprise value!

This relationship appears throughout the dataset. For example, the companies in the top half of the NRR distribution show an average EV / Revenue ratio** of ~25x, while those in the bottom half show only ~10x. What’s more, the company with the lowest NRR of the group (New Relic) has the 3rd lowest revenue multiple, while that with the highest NRR (Snowflake – by a lot!) boasts the strongest multiple.

Conclusion

A lot has changed in public markets in recent years. Still, NRR’s importance to a company’s long-term success and valuation has remained remarkably consistent (see SEG’s similar analysis from 2020.) Because of this, most SaaS businesses now realize that Customer Success is their number one growth engine—for growing client value, growing revenue, and growing shareholder value. So how do you increase NRR? Check out how Gainsight and our customers did it.

Learn the Four Essential Capabilities Every CS Platform Must Support

Download the 2023 Gartner Market Guide for Customer Success Management Platforms for a breakdown of seven different customer success platforms and insight on how the customer success industry has evolved in recent years.

Notes:

*EV / Revenue multiple data was pulled from BVP on May 14, 2021; Net retention data is based on the latest company filings as of May 17, 2021, using data listed either as net retention rate or net dollar expansion rate

**Simple arithmetic average