“If you need more revenue, invest in Sales.”

Why is that the default—some might say “kneejerk”—response to the basic question of how to make more money?

One of the reasons Sales is such an obvious economic driver for companies is because its core Key Performance Indicator (KPI) is meaningful and well-defined: bookings.

But for businesses implementing Customer Success, many struggle with defining the final financial KPI. While everyone agrees that leading health score indicators (e.g., adoption, maturity, satisfaction, etc.) are what you should action day-to-day, every Customer Success team needs to define the final “lagging” indicator to use with finance, executives, and the board.

It shouldn’t surprise you that that metric is retention. But unlike in Sales, there’s debate over which retention metric to anchor upon: Gross Retention Rate (GRR) or Net Retention Rate (NRR).

GRR takes into account churn, but doesn’t benefit from expansion—hence the max is 100%. NRR includes expansion, and therefore can (and probably should for most companies) be over 100%. Click here to get more details on calculating these numbers.

Gross Retention vs. Net Retention

So how do you choose between GRR and NRR as an anchor KPI for your post-sales/CS organization?

I’ve thought about this a great deal as I’ve met thousands of companies over the years and realized that there isn’t a one size fits all solution. But I am convinced there’s a framework to help you make the right decision for your company.

At first glance, it’s tempting to automatically assume NRR is the better indicator because it synthesizes two revenue streams—the renewal and the upsell. In a nutshell, it includes more information. But that’s not necessarily the case.

On one hand, GRR has an advantage over NRR in that it truly measures the long-term health of the business because gross churn erodes expansion opportunity over time. In other words, you can’t upsell clients that you lose!

On the other hand, an over-focus on gross retention and churn can lead to a point of diminishing returns.

And this focus has practical effects every day. Do I focus on the nth at-risk client and trying to save them (sometimes in futility) or take that energy and spend it on a healthy client ripe for expansion?

3 Dimensions to the GRR vs. NRR Problem

There are a few core dimensions to consider in this problem:

- Financing: Are you private and needing to raise additional capital? In that case, investors may scrutinize your GRR. Alternatively, are you public or do you plan to go public? In that case, you likely will be reporting NRR.

- Growth Rate: If you are growing fast and valued on growth, NRR may have a larger economic impact near-term. On the other hand, slow-growth companies can receive great ROI from optimizing GRR (and therefore churn).

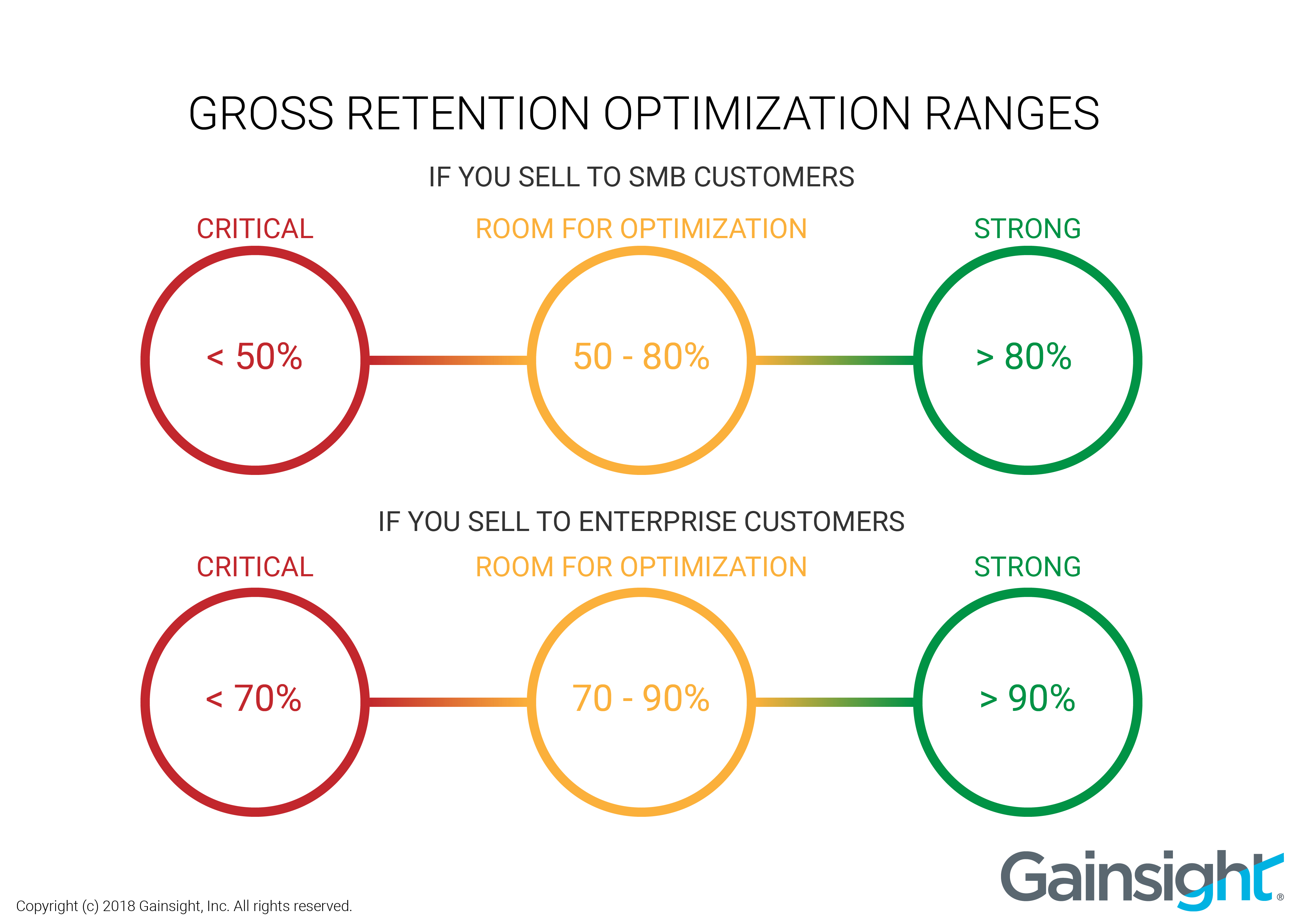

- Current Gross Retention: In general, there is a bright line for GRR and you don’t want to go below it. Depending on your target customer segment and Customer Acquisition Cost (CAC), that rate could be below 60% (for SMB) or below 70% (for Enterprise). Below a certain point, investors look at a business as being not viable, and the churn rate indicates more fundamental, systemic challenges.

It all comes down to how optimized you are around Gross Retention—or to put it another way, how optimized your renewal mechanism is. If that mechanism fully optimized or very efficient, the higher-ROI focus might be around Net Retention. My recommended GRR ranges are:

So Do I Optimize for GRR or NRR?

If you’re a private company needing more capital, I would work hard to get your GRR to the Fully Optimized level, since investors will notice. If you’re public and reporting NRR, you can probably live in the zone of “Room for Optimization” for GRR and focus on improving net retention. Similarly, the higher your growth, the more you should focus on Net Retention versus Gross Retention.

It’s certainly a continuum, but if you’re a high growth public company with a 97% GRR, you might take those incremental hours spent chasing the pesky few RED customers and instead double down on your successful ones to help them grow and expand.

My team built a free web tool to calculate NRR and GRR as well as four other CS benchmarks. Click here to try it out for yourself—it’s pretty handy!