As CEOs, our job is to maximize the upside while protecting the downside. Depending on the phase of our business, the mix between fear and greed can ebb and flow.

The good news is that Customer Success is becoming an important part of the strategy in all seasons of business, good or bad. That being said, because Customer Success is one of the newest disciplines in business, I’ve seen companies consistently make mistakes in planning that come back to bite them.

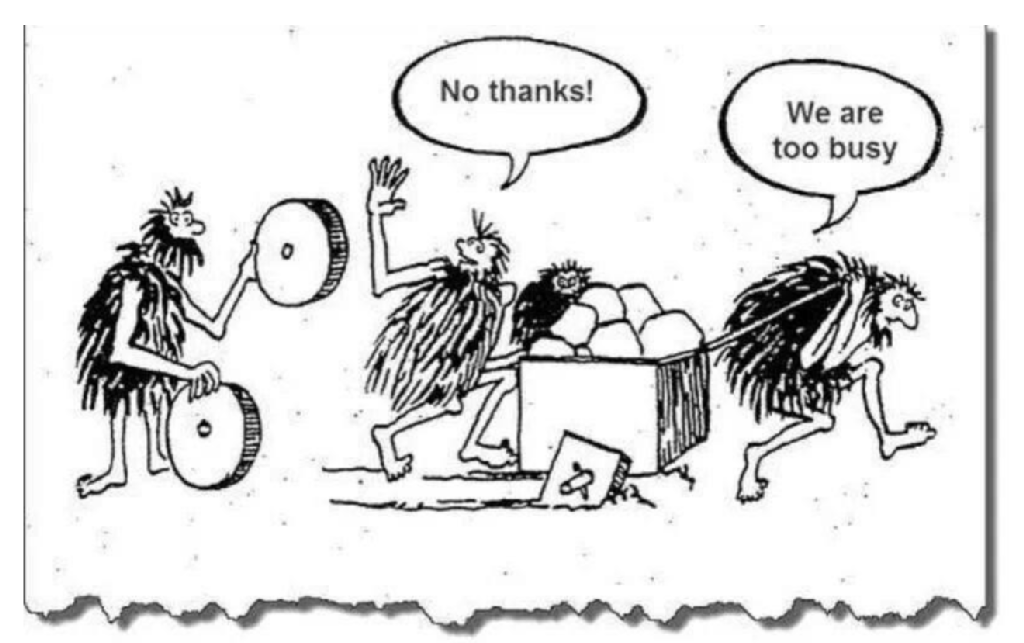

And, as Albert Einstein also famously (but apocryphally) said, “Insanity is doing the same thing over and over again and expecting different results.”

This post is all about avoiding those errors for 2018. I’ll share the top ones I’ve seen and welcome your input as well.

Fail #1: Underfund Customer Success

Have you ever shown up for a family dinner late, only to see your relatives smiling and full, their plates clean and only scraps left for you? Sometimes that’s what it can feel like in terms of getting budget as a Customer Success leader.

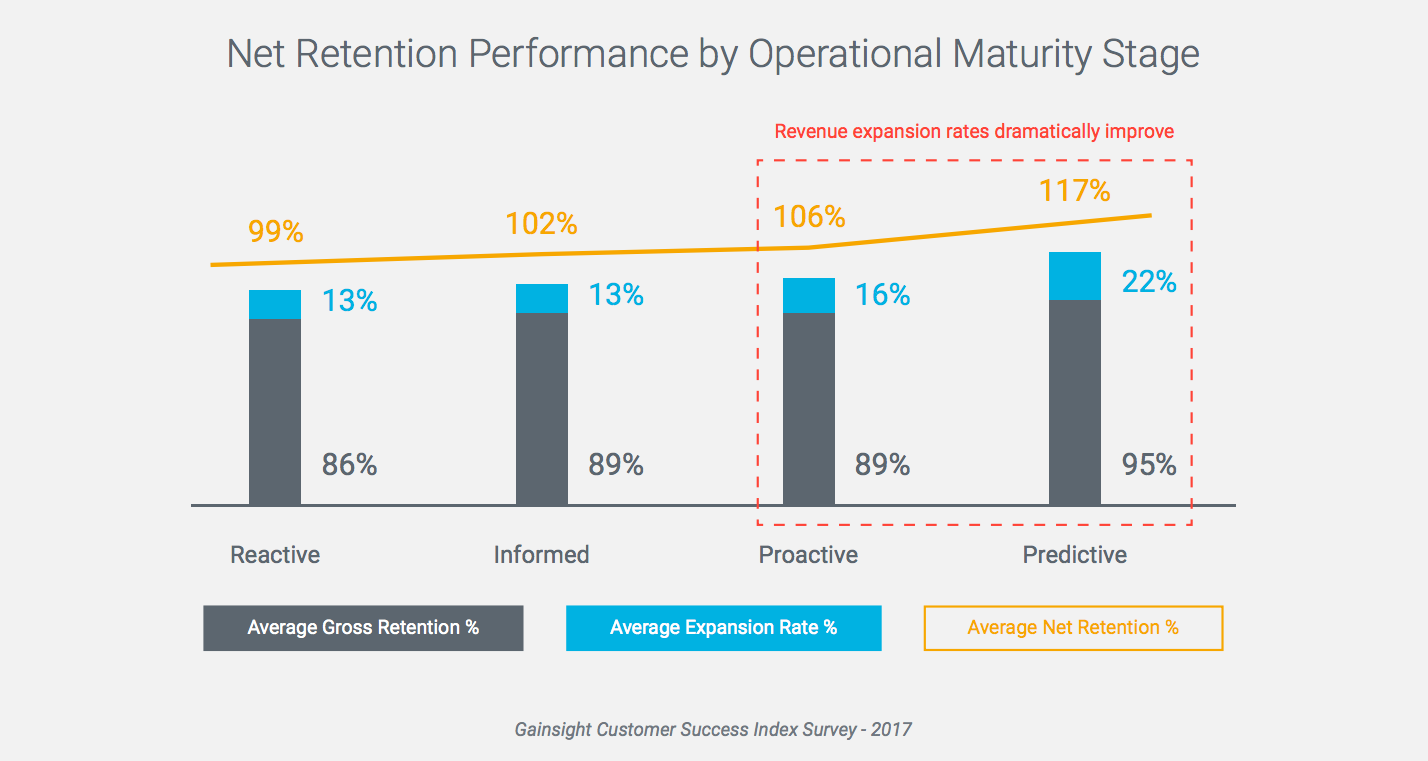

While prominent thought leaders like McKinsey, Bain, Gartner, Forrester, and Geoffrey Moore have all talked about the ROI of Customer Success, and while we at Gainsight have, in our benchmarking study, shown an 18 point growth improvement from investing in Customer Success, many companies are still underinvesting in the area.

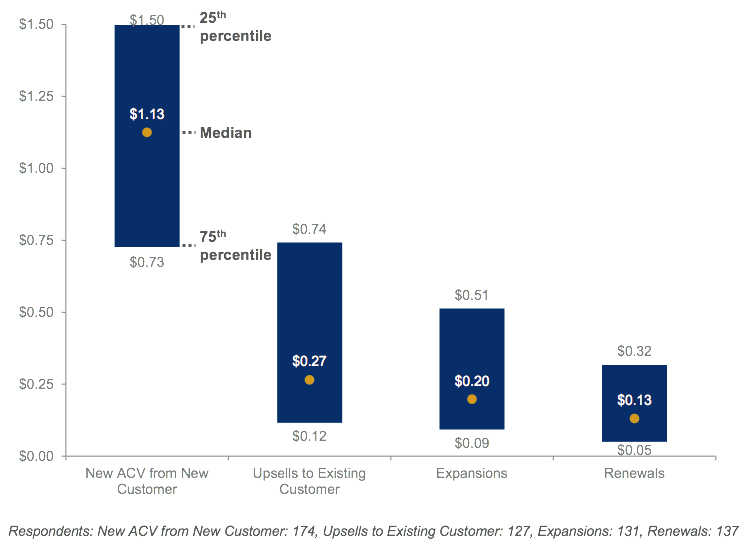

Investment bank Pacific Crest shows that the typical growth stage company is investing 13 points of recurring revenue in Customer Success/Renewals.

Anecdotally, I’ve seen this scale down to 4 to 8 points as companies grow, but many businesses are at less than 1%, so there is still a big gap.

Tip #1: Agree early with your CFO on a target ratio for Customer Success as a fraction of revenue.

Fail #2: Stretch Customer Success Thin in Budget

At the same time, with a limited budget, companies often sign up for more than is feasible in terms of Customer Success. They want a Customer Success Manager for every account. They want to radically improve onboarding. They want to overhaul the entire Customer Experience. Using another powerful—but anonymous—quote from the past: “You and what army?”

You need to be able to give something up if your budget is limited. Rather than skimping on the items that make your team more efficient and effective, I would recommend curtailing what you can cover:

- Maybe CSMs only get involved post-onboarding.

- Maybe CSMs can’t do renewals anymore.

- Maybe CSMs don’t cover some accounts, with a pure “tech touch” model instead for those.

- Maybe CSMs need to push more work to Support and Services.

On my LinkedIn, I asked my community for their most relevant budgeting fails. Somit Goyal, Global Head of Customer Success with Microsoft Dynamics, made a very salient point about clearly understanding your CS org’s charter in the budgeting process. His example of a budgeting fail was: “Approaching funding without clearly defining the CS charter (onboarding, adoption, renewal etc.) and aligning with generic industry guidelines like X% of revenue for CS or $YM of ARR per CSM without taking into account things like product complexity, etc.”

Tip #2: Constrain your plans for 2018 based upon your budget available—and clearly communicate those plans to the rest of the company.

Fail #3: Mixing Entering and Exiting Costs in Budget

Because Customer Success is relatively new, there is a great deal of building to be done. As such, during a year, a lot may change in terms of your cost structure:

- Team members will be hired and ramped.

- New clients will be signed and come onboard.

- New products will be launched, etc.

While you may target 12% CSM cost as a fraction of recurring revenue by the end of 2018, it may take starting at 16% to get there.

David Verhaag, VP Client Experience at Degreed, had a great insight into one potentially huge mistake along these lines in his comment on my LinkedIn post: “Not modeling on ‘surge’ efforts that might be required for major initiatives impacting the customer base or risk management efforts.”

Tip #3: If you agree with your CFO on a cost model, make sure to be clear whether it’s an entering or exiting cost target.

Fail #4: No Business Case to Support Your Budget

Enough about costs already. Customer Success is NOT a cost center—it’s a growth driver. That’s easy to say, but what’s your business case?

How much evidence do you have to prove to your (likely skeptical) CFO that this has an impact? In 2017, did you:

- Break down a cohort of clients into a “test” (A) and “control” (B) group to compare results when you intervene versus when you don’t?

- Track the key growth drivers from your team—namely:

- Renewals: At risk accounts saved

- Expansion: Upsell/cross-sell leads sent to Sales

- Advocacy: Case studies and references sent to Marketing

- Identify early indicators of churn or expansion with statistical validity that your team can act on?

Tip #4: Build a financial model (your CFO likely speaks Microsoft Excel) showing the impact of your team. We made a template as a quick way to get you started.

Fail #5: Bad PowerPoint to Support Your Budget

Even if your CFO lives in Excel, your exec counterparts will eventually pitch their plans to the CEO in slides. While it may be trivial, great slides make people feel like the strategy is sound and well thought out. Do you have a “Customer Success in 2018” deck? I’d include:

- Your charter from your team

- Recap

- Results from 2017

- Learnings from 2017

- Looking forward

- Targets for 2018

- Strategy for 2018

- Budget for 2018

Tip #5: Even if it involves getting a design contractor, make a nice deck for your 2018 plan.

Fail #6: Customer Success Not Being In the Right Part of the Financials

Is Customer Success cost a Cost of Sales and Marketing (S&M) or a Cost of Goods Sold (COGS)? Is it a revenue driver or a cost center?

We did some research and the answer is there are companies out there who put it in either bucket.

No matter what the accounting says, however, there is a fundamental superposition in Customer Success (my first quantum mechanics reference in the article!) between impacting these two buckets:

- COGS: Some of Customer Success is inherently part of your core offering. People buy your product or service assuming they will get help. Some of that help might come from your Customer Support, Services, and Training teams. But some may also come from CSMs. The more you have other scalable resources (support, training, professional services, community, etc.), the less CSMs probably do “delivery” work. One way to think about this: if your CSMs were all on vacation for a year, would your clients still be able to get value?

- S&M: On the flip side, much of what your team does is also about revenue. Are they doing work to make sure the client gets enough value to renew/retain? Are they identifying leads for the Sales team? Are they creating advocates for Marketing?

Tip #6: Do a quick “time study” of how much time your CSM team spends on COGS-related activities versus S&M-related; share this with your CFO.

Fail #7: Hire CSMs with No Ops Support

I remember the days when you used to have to convince leaders to hire Sales Operations. “Why do I need Sales Operations? Here’s the phone book—start calling!”

As they learned the benefits of consistent process, automation, enablement, and data, companies started realizing that Sales Operations is a critical part of Sales. In fact, I recently talked to the president of a rapidly growing public company who budgets 0.2 FTEs in Sales Operations for every one Account Executive.

In Customer Success, we’re still in the old “phone book” world. CSMs work in spreadsheets, live with bad data, have no consistent processes, and get very little training. Meanwhile, their aggregate headcount cost dwarfs a relatively small amount of spend on operations.

Some companies might say, “Oh, we let the CSM team share resources from Sales Operations.” How is that working out? If your job title says “Sales Operations,” I’m pretty sure I know what you prioritize first.

In the last few years, the hottest trend I’ve seen is Customer Success teams investing in operations. In the comments on my LinkedIn post, I was not surprised to see a ton of people highlight the need for Ops support.

Tip #7: If you don’t have a Customer Success Operations person, budget for one. If you have one already, grow the team.

Fail #8: Not Talking to IT In Your Planning

Per the above, you are likely to have IT needs in 2018, whether it’s:

- Process implementation

- Tool setup

- Systems cleanup

In general, I feel that Customer Success teams don’t partner enough with IT—to their own peril.

If you have projects next year (NPS, playbooks, onboarding, etc.), is IT aware of them? Are you giving them advance notice on what they need?

Oftentimes, the limit won’t be your budget—it will be IT’s.

Tip #8: Meet with your IT lead now about your needs for next year.

Fail #9: Not Aligning With Sales and Marketing In Budgeting

What are your Sales team’s plans for next year? Going International? Expanding to SMB? Where sales goes, CSM needs to follow. Every new customer needs support from CSM in some way. If you haven’t met with your head of Sales by now about next year’s plan, you are behind the curve. Where do you need to staff up? Where can you defocus? Is sales reorging? Do you need to?

And don’t overlook how Marketing will impact your budget next year. Multiple people wrote on my LinkedIn post about the need to account for Marketing projections and take advantage of their capabilities. Are they hiring someone to support customer engagement or customer marketing? If not, do you need to?

David Verhaag made another great point in his comment: “Failing to budget cross-functionally for roles supporting CX like Marketing and Solution Engineering (more CX requires more support cross functionally).”

Shawn Riedel, a consultant for Oracle, wrote about the importance of “working with Marketing on budget/bandwidth for install base, feature/function launch, and renewal campaigns.”

Tip #9: Get an early view of your 2018 sales and marketing plan now.

Fail #10: Not Investing In Developing the Team

So now you have a great budget with new hires, IT help, and maybe an ops person or two. If you’re like many CS teams, you’ll end up spending all of your precious budget on the business and very little on developing the individuals.

Your CS team will be watching the Sales team having:

- An expensive “kickoff” and maybe even another at mid-year

- Professional sales training coming in

- Attendance to major sales thought leadership events like Salesforce’s Dreamforce

- Maybe even a full-time enablement resource or team

What about the Customer Success team that’s talking to your clients every day?

It’s not a lot of money, so plan for it upfront. Budget for:

- Customer Success to be at your Sales kickoff

- Professional Customer Success training

- Customer Success conference attendance

- Building a Customer Success enablement function

Along those same lines, we send AEs all around the world to build face-to-face relationships with prospects and clients, and those costs are baked into the Sales budget. Your CSMs’ relationships are equally valuable, and you’ll need to plan ahead for the expense.

On my LinkedIn post, Daniel Rose with Qubole wrote, “I think we commonly can miss the human interaction costs (travel, customer events, entertainment). There is no dollar value you can put on the return of building lifelong relationships with your champions.”

Tip #10: Plug in training, travel and, bonding into your budget from the start.

Fail #11: Not Leaving Room for Experimentation

Let’s be honest—very few of you reading this even had “Customer Success” teams a few years ago. The space has grown rapidly and evolves every month. Should you tier your customers by ARR? Should you pool CSMs? Should you have both CSMs and AMs? These questions are all in a state of flux and highly individual to each situation.

So you are likely to be mid-year and wishing you had resource to try something new. Maybe you hear an idea from a colleague at another company? Maybe you want to experiment with a new technology? If you commit your annual budget upfront, you will only evolve on an annual basis.

Tip #11: Leave room for experiments in your budget

Fail #12: Not Investing In Systems

[Shameless commercial warning]

While Customer Success is certainly about People and Process—like all areas of business—it can still greatly benefit from technology. Almost every new business process (like CS) is “piloted” on spreadsheets and Google Docs. The question is can you scale faster at some point through systems?

While the classic benefits of systems are the same in any field (consistency, automation, tracking), I think one of the unique benefits of systems in Customer Success is in enabling the experimentation that’s needed in a new field.

Do you A/B test approaches to Onboarding? Can you compare time to value for different products? Can you look back consistently at patterns in churn or growth?

As the old adage goes…

Tip #12: Plan for systems investments in 2018.

Fail #13: Starting Budgeting Too Late

As I opened up with, CS leaders are often brought into the process at the end, leaving them with the proverbial scraps at the dinner table.

If your budget year starts on 1/1 or 2/1 and we are sitting here in August, you’re on the verge of running out of time.

Tip #13: Get started on your 2018 budget now.

How can we help?

Obviously at Gainsight, we have a vested interest in CS succeeding. I’d like to offer up my team on a complimentary call for you to:

One more thing: we have a very high-value webinar coming up featuring our very own CFO and CCO, Igor Beckerman and Allison Pickens. They’re going to spend a HUGE chunk of this webinar answering listener questions directly, so don’t miss it!

Although it might feel like the thick of summer, the New Year is upon us. Get ready.