- Products

- Pricing

- Solutions

-

-

By Use Case

- Digital Customer SuccessScale effort and align teams using digital-led strategies.

- HealthcareDeliver proactive, preventative care that enables you to retain and grow your customer base.

- Start and Scale FastEssential features and onboarding to help you start and scale with Gainsight in as little as two weeks.

- Scale and EfficiencyDeliver outcomes without adding headcount.

- RetentionPredict churn and address risk.

- ExpansionIdentify and align on expansion opportunities.

- Product AdoptionProactively guide users to value.

-

By Team

- Customer SuccessEmpower and enable your CSMs.

- ProductCreate elegant product experiences.

- Customer ExperienceIdentify trends across the customer journey.

- Revenue and SalesDrive a high performing renewals process.

- IT and AnalyticsConsolidate your Customer Data.

- ExecutivesAlign on customer health and opportunities.

- Community TeamsBuild a modern customer community.

-

-

- Customers

- Resources

- The Latest from GainsightWhat’s new? From blogs to webinars, to guides and more.

-

-

Gainsight Essentials

The Gainsight you know and love just got a whole lot easier. Start and scale with Gainsight - and go live in as little as two weeks! What are you waiting for?

Check it Out- By TopicWe’ve got it all organized by Product, Customer Success, and Community.

-

-

Pulse 2023

Pulse 2023 is more than software’s biggest conference on durable growth. It’s a celebration of ten years of joy, and an invitation to ask what if about a future that’s yet to be written.

Check it Out- Customer ResourcesFind the Gainsight community, certifications, and documentation.

-

-

Gainsight Customer Communities

Create a single destination for your customers to connect, share best practices, provide feedback, and build a stronger relationship with your product.

Check it Out- Industry ResourcesFind a job, discover Pulse, and learn what’s happening industry-wide.

-

-

Industry Resources

- Customer Success Job Board

- Pulse Plus

- Pulse Conference

- Pulse Library

-

Pulse 2023

Pulse 2023 is more than software’s biggest conference on durable growth. It’s a celebration of ten years of joy, and an invitation to ask what if about a future that’s yet to be written.

Check it Out- Essential GuidesIf it’s here, it’s essential knowledge on CS, PX, and community.

- Company

- Impact

- Login

- Schedule a Demo

- Essential GuidesIf it’s here, it’s essential knowledge on CS, PX, and community.

-

- Industry ResourcesFind a job, discover Pulse, and learn what’s happening industry-wide.

- Customer ResourcesFind the Gainsight community, certifications, and documentation.

- By TopicWe’ve got it all organized by Product, Customer Success, and Community.

-

- The Latest from GainsightWhat’s new? From blogs to webinars, to guides and more.

- Products

- Pricing

- Solutions

- Customers

-

Resources

- The Latest from Gainsight

- By Topic

- Customer Resources

- Industry Resources

-

Gainsight Essential Guides

- Quarterly Business Reviews (QBRs)

- Customer Success

- Voice of the Customer

- Customer Success Management

- Customer Journey and Lifecycle

- Professional Services Success

- High Touch Customer Success Management

- Company-wide Customer Success

- Recurring Revenue

- Channel Partner Success

- Product-Driven Customer Success

- Churn

- Budgeting for Customer Success

- Product Analytics

- Customer Experience

- Business Metrics

- Choosing a Customer Success Solution

- Product Management Metrics

- Company

- Impact

- Login

The Essential Guide to

High Touch Customer Success Management

Everything you need to know about High Touch Customer Success

Just because High Touch CSM involves more human capital, face-to-face interaction, on-the-fly decision making, and higher-level strategy doesn’t mean that process is less important. It’s exactly the opposite. Adhering to operational best practices and tactical processes is even more crucial for ensuring the success of your largest footprint customers.

Chapter 1

High Touch: Art vs Science

We hear these statements a lot:

- “High-touch Customer Success is more art than science.”

- “Our high-touch CSMs know their customers well. We don’t need a lot of process.”

- “Our high-touch CSMs are really senior people. They don’t need a lot of process.”

Respectfully, we disagree.

Here’s what’s actually going on in your strategic accounts:

- You can’t afford to mess up. Investors expect renewal rates north of 95% in this segment. That means every single renewal needs to come in. If you lose a 6-figure or 7-figure account, it could ruin your quarter. And there isn’t much room for downsell. Every single at-risk account presents a major issue. And by the way: Your high-touch clients. Notice. Every. Detail.

- You’re dealing with lots of political complexity. You’ve got potentially dozens of senior stakeholders who tend not to see eye-to-eye. You’re herding cats. If you haven’t addressed stakeholder engagement in a methodical way, you’re lost in the jungle.

- Your single large client is actually many little clients internally. You’ve probably sold multiple products to them, across multiple business units, with some units engaged in services engagements and others not. This might seem like high-touch CSM at the surface, but your real-life “accounts to CSM” ratio is actually very high.

- You’re working through massive change management. It’s critical that you have a strong perspective on what specific activities need to be done and what specific milestones need to be achieved. Your methodology is your lifeblood.

- Losing a CSM could be disastrous. Big clients want the red carpet. They don’t like losing their CSM. They also don’t like having to get a brand new CSM up to speed. And you as the vendor could be in a terrible spot if your CSM leaves. You need to retain all the knowledge you can in institutional memory, not just your CSM’s head.

- Your large clients want you to own the outcome for their business. A senior exec’s job is on the hook. But, chances are, everyone at your company has forgotten what the client really wants. The objectives discussed in pre-sales are buried in a salesperson’s notepad. Your CSM is so tied up in standing meetings that it’s easy to lose sight of the bigger picture.

- A corollary: You will be on the hook for every issue—your issues AND the client’s issues. Large clients don’t often distinguish between them. So you need to own the entire outcome.

- Your senior CSMs don’t want to do repetitive stuff. They’re senior. Not worth their time. They want resources and a lot of air cover. They want the red carpet from their managers.

- If you’re not growing, you’re shrinking. In high-touch accounts, status quo is not sustainable. You need to constantly be planning how to get more strategic and larger in the account—or you will be engineered out.

- You need to herd cats within your company. You need to ensure your Services team is driving for value and not just project completion. You need your Product team to engage your clients in roadmap discussions. You need to get your Support team to prioritize certain cases. Your CSM’s head is spinning trying to manage all these departments, and s/he wants your help in paving the way.

So, at Gainsight, we believe in creating process to help our high-touch CSMs. Here’s how we recommend doing it.

Chapter 2

Managing Risks

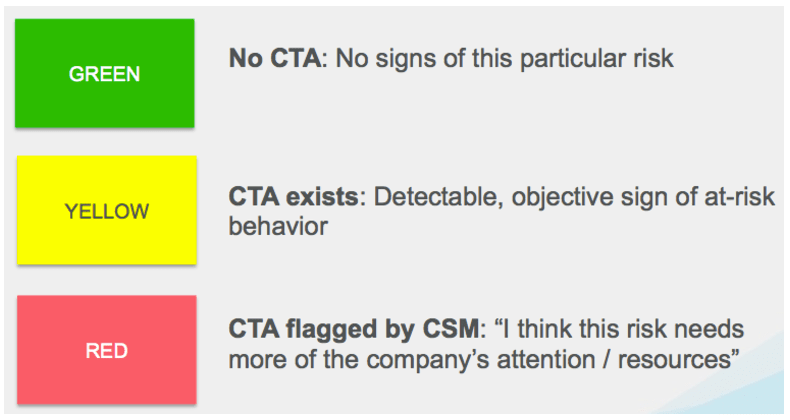

We’ve discussed in the past how the Managers within our Gainsight Customer Success team work with their CSMs to manage risk in client relationships using Risk Calls to Action (CTAs) and Scorecard Measures. But front-line Managers can’t be the only ones enduring sleepless nights when a strategic client is at risk. Your Chief Customer Officer (CCO) should be aware and offering advice to the team, too.

Here’s how risks for our largest clients are escalated to the CCO:

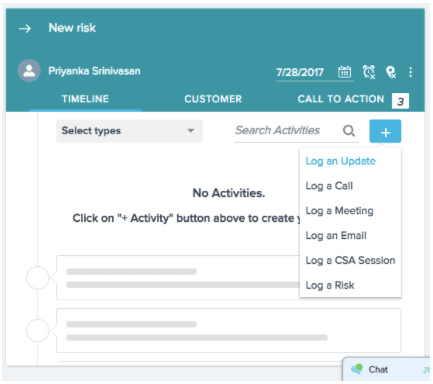

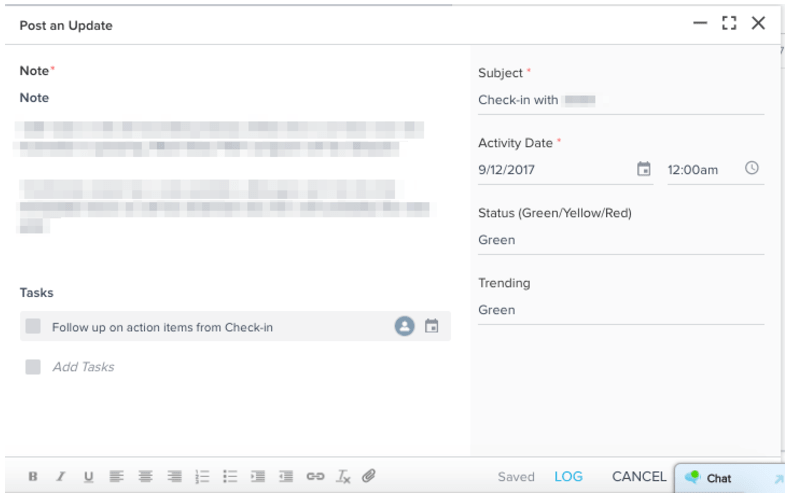

Every week, prior to their 1:1s with their Managers, our individual contributor CSMs methodically review their existing risks as well as create new Risk CTAs if needed. Using the Timeline feature within the CTA, they “Log an Update” for all open Risk CTAs.

Figure 1: CSMs provide a summary of their risk through “Log an Update” in the Risk CTA Timeline

Figure 2: CSMs provide summaries for all open risks on a weekly basis via the Risk CTA Timeline

CSMs do this weekly for all risks and provide three pieces of information in these weekly updates:

- Summary of the current situation including “temperature” and “direction” (i.e. is the client “warm” / doing well or “cold” / unresponsive or worse)?

- How s/he is “pulling out all the stops” to address the risk.

- Specific help needed from his/her Manager, if any.

Prior to the Wednesday 1:1 with his/her Manager, the CSM flags any risks for which he/she needs the Manager’s input.

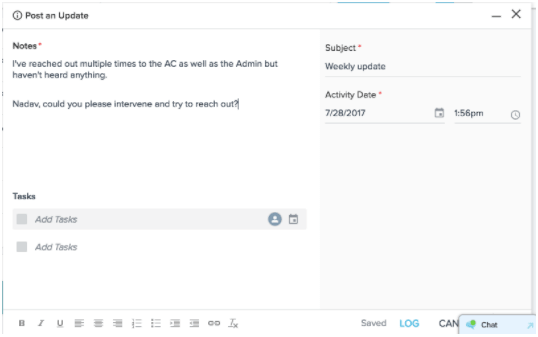

During Wednesday 1:1s, Managers review all flagged risks together with their CSMs and discuss a plan for each. In most cases, the team is able to address the risk without any CCO input. But sometimes, the Manager wants to escalate it to the CCO because s/he (1) wants feedback from her on how to proceed or (2) wants to make sure the CCO is simply aware, in cases where the risk is quite severe.

If the Manager wants to escalate, s/he logs his/her own update via the same “Log an Update” Timeline feature. This way, the CCO can get the Manager’s perspective on the risk in addition to the CSM’s.

Prior to end-of-day Thursday, the Manager escalates the Risk to the CCO by selecting from a drop-down within the “CTA Detail” section of the Risk CTA. It is a simple drop-down with two options: “Escalate to [CCO name]” or “Not Escalated to [CCO name].”

Figure 3: Managers escalate risks to the CCO using a simple dropdown within the CTA detail section

On Friday, the CCO reviews all of the Risk CTAs that have been escalated to him/her within his/her Cockpit. The CCO can click into each one and review the Timeline history of the risk and what the team has been doing most recently to address it.

To share feedback for them, the CCO would log his/her own “Update” to the risk Timeline. To notify Managers of an action item or next step, the CCO adds them in a Task (this is a feature within the “Log an Update” in Timeline). They will then immediately be notified that the CCO has reviewed the risk and that a next step is waiting for them!

Finally, feel free to replace all of the “CCOs” in there with “CEO” or any other member of the Exec team. For example, at Gainsight, our CEO, Chief Revenue Officer, as well as CFO all also regularly review risks alongside the senior leadership within our CS org.

It’s all about the process!

This process is just as much about utilizing the Risk CTA in a specific way as it is about the weekly process. In order for the CCO to provide feedback on all escalated risks on Fridays, our CSMs must log their updates and meet with their Managers by EOD Wednesday, so that Managers can provide feedback and escalate to the CCO by EOD Thursday.

Chapter 3

“You’re dealing with lots of political complexity”

Systematize Executive Sponsorship and a VoC Program

2(A): Executive Engagement/Sponsorship

Our CSMs might be working day-to-day with a director-level person, and that work is critical. But it’s equally important to ensure that we’re in close touch with the executive, who sets the objectives for the engagement and makes the decision on the renewal. Our leadership provides air cover for his/her team members by aligning with executives at our clients.

How to set up an Exec Check-in:

The goal of an Exec Check-in is threefold:

- Get a pulse-check on an individual customer from the Exec’s perspective

- Learn about any top-of-mind initiatives they are working on

- Share any insights or best practices that might be helpful in the current moment

The last one could mean anything from sharing thoughts on how to structure a team or process to get the most of the product, to sharing learnings from customers who have faced similar challenges.

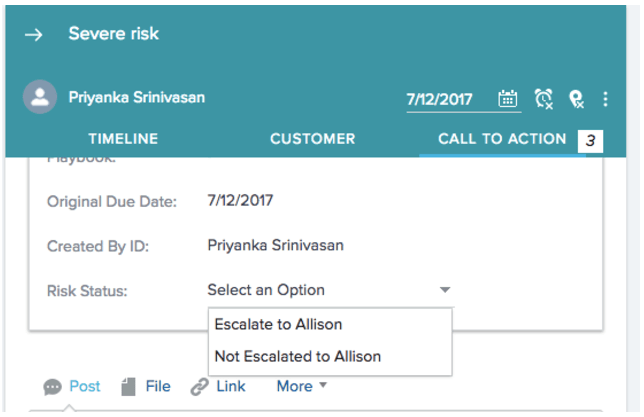

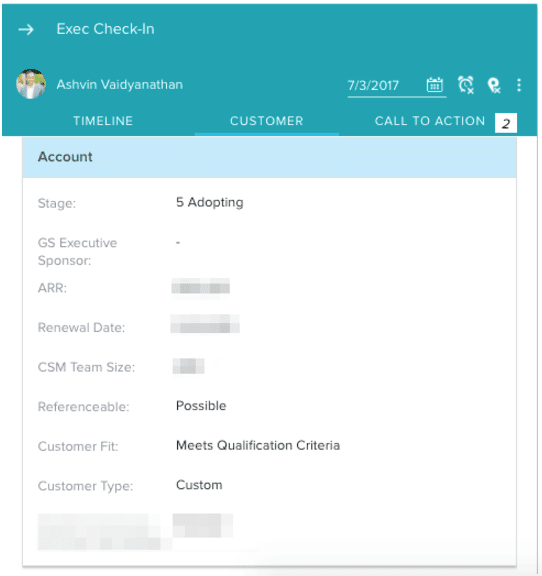

We suggest that your VP of CS (or other member of leadership, depending on the customer relationship) reach out to an Exec-level individual at each of your customers on a quarterly or twice quarterly basis. Your senior leaders are busy people, so you can set up these reminders via a CTA.

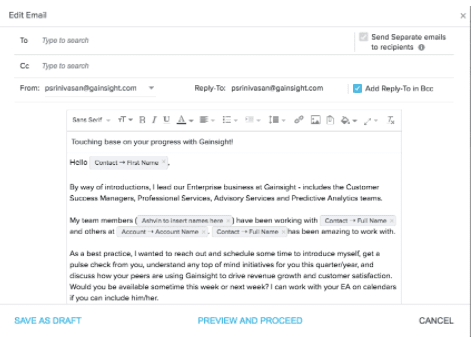

Figure 4: An Exec Check-In CTA is triggered to remind our VP of CS to check in with the Exec contact at a customer

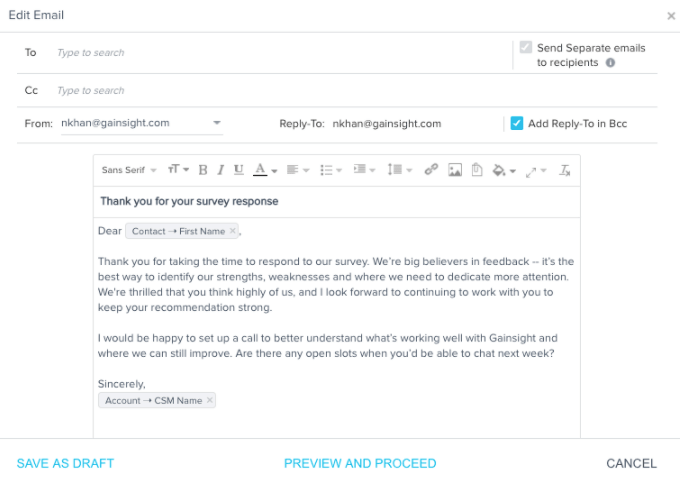

For example, every month, our VP of CS receives a CTA for a specific customer reminding him to reach out to the Exec contact at that customer (we call this an “Exec Check-In CTA”). This CTA has an associated Task with an Email Assist that our VP edits as needed and then sends out to the customer.

Once the Exec Check-in is completed, our VP posts his notes to Timeline via the CTA and drops a Milestone to track the last check-in.

Figure 5: Exec Check-In Email Assist

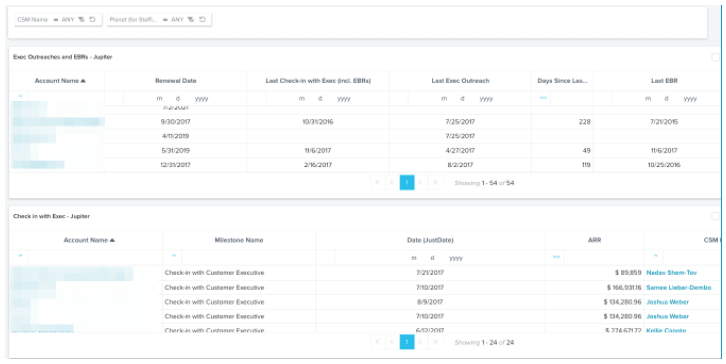

Finally, you might want to consider building out a dashboard to track all of your upcoming Exec Check-Ins for the quarter as well as how many have been completed. This gives your team a view into where they might need some VP coverage.

Figure 6: Exec Check-In Dashboard

2(B): VoC Program

A strong Voice of Customer (VoC) program is a critical component to providing high-touch Customer Success. But a VoC program is more than simply listening to your customers—it also means closing the loop and following up with an action, so responses translate to improvements in the product and customer experience.

We have an easy 3-step framework for VoC:

- Listen: Capture insightful feedback by giving your customers frequent opportunities to submit feedback.

- Act: Follow up promptly so customers know that they are heard. Quicker response to customer feedback results in a greater impact.

- Analyze: Assess progress against goals and measure improvement to keep the program on track.

Step 1: Listen

Develop a Set of Personas

If your customers are anything like ours, you don’t have just one stakeholder, you have multiple—and you want to make sure you are gathering feedback from all of them. We tend to see at least five types of stakeholders (or “personas”) at most of our customers: the End User, the Admin, the Adoption Champion, the Executive Sponsor, and the Big Boss.

For each persona, we suggest you carefully lay out (1) what you’d love to see from them and, in turn, (2) what they need to see from you to be happy.

In practice, to track these roles, we recommend creating a new field on the “Contact” object to capture these roles for each customer. Try to fill these out as early as possible in the customer relationship—e.g. at the beginning of the post-sales kickoff with the customer but ideally in pre-sales.

Listen Through a Regular Feedback Cadence

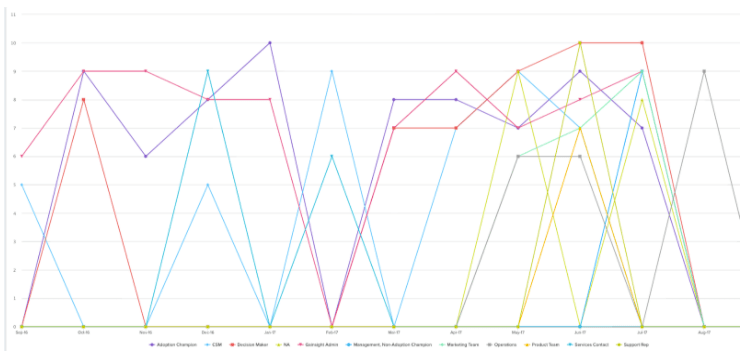

We send an NPS survey via CoPilot to all stakeholders at each of our customers once every six months. We then slice and dice the NPS results by persona type. That’s critical, since for a given customer, we might find (for example) that the End User NPS is very high (the actual users love it!) but the Executive Sponsor NPS is low (indicating that the Exec contact may need some help seeing the value of the product).

We also send follow-up NPS questions by each department within Gainsight that a customer interacts with—e.g. the Product team, the CSM team, the Marketing team, etc. That way we can inspire other departments at Gainsight to improve the customer experience.

Listen Through Transactional Surveys

We also collect feedback after key milestones in the customer’s lifecycle or after service touch-points to gauge whether expectations were met.

- 60-days after deal closure: We distribute a Sales Expectations Survey 60 days after a deal has closed to gather feedback on whether we met the expectations in onboarding that the AE set for the customer during the sales process.

- Post-Onboarding: Once the onboarding phase has been completed, we send an Onboarding survey to gather feedback on the engagement.

- After a support case: Once a support case is closed, we trigger a Support survey to gauge whether expectations were met.

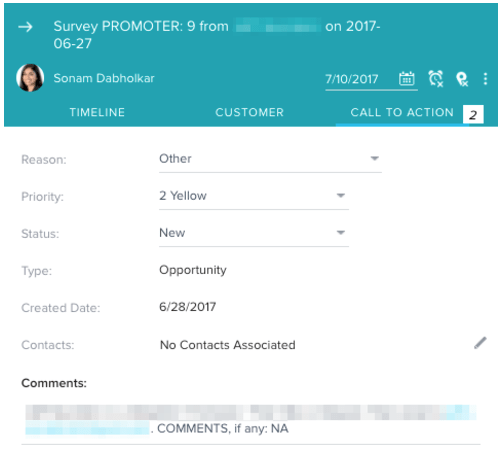

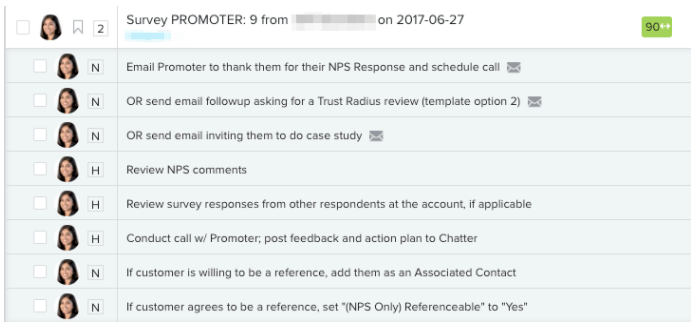

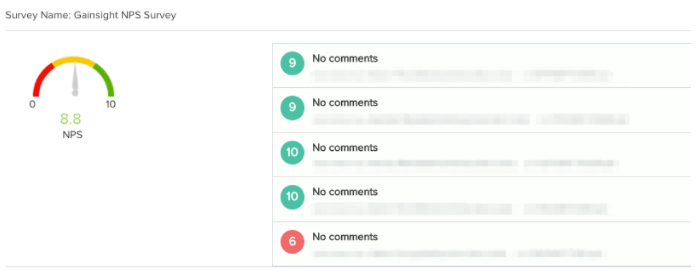

Step 2: Act

It is important to close the loop and follow up on customer feedback immediately—be it positive or critical. We recommend implementing follow-ups in an “if this, then that” manner. For example, upon receiving a particularly low NPS score from a given customer, we recommend triggering a CTA with with an associated Email Assist response in order to reach out for a conversation. Conversely, if an NPS score (or set of scores) is extremely high for a customer, your CSM might consider reaching out to ask whether the customer would be willing to serve as a Sales reference or participate in a testimonial for your Customer Marketing efforts.

Figure 7: NPS follow-up CTA and associated Playbook

Figure 8: NPS follow-up Email Assist

Step 3: Analyze

Once you have a strong listening program up and running, you will very quickly be collecting a large amount of valuable data. One of the most important uses of this data is benchmarking—that is, seeing how customers (or personas) stack up against each other or over time.

The quickest way to visualize the results of a given customer’s NPS survey (both at a current point in time as well as the trend) is to access the Surveys section of the C360. We have this section configured to show our CSMs average NPS by role over time:

Figure 9: NPS Chart by Persona

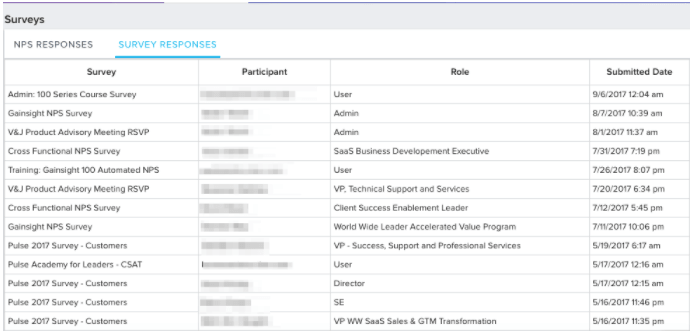

In order to dive deeper into individual responses, the Surveys section has a tab specifically dedicated to NPS. Within this section, our CSMs can view each respondent’s individual NPS score (plus comments).

Figure 10: NPS Section for a Given Customer

Finally, to view responses to the one-off transactional feedback surveys described above, our CSMs navigate to the “Survey Responses” tab next to the “NPS Responses” tab within Surveys. Here they can find and access the responses to all other surveys sent out through the platform.

Figure 11:Survey Responses (for Transactional Surveys)

We recently released a new VoC Solution that helps solves the specific need around gathering and acting upon a customer’s feedback. To learn more about our VoC best practices check out our Intro to VoC content.

Chapter 4

“Your single large client is actually many little clients internally”

Use Relationship360

Within some of our clients, there are often multiple BUs, geographies, or functions that may have different stakeholders, business goals or even be in completely different lifecycle stages (i.e. stages of product deployment/adoption). From an account perspective, they could even have completely different contracts. In a sense, this client is actually multiple clients internally (with sometimes very different high-touch workflows), and you may even consider staffing separate CSMs to each of them. We need a tool to keep track of and manage each of these different “relationships” separately, which is exactly what Gainsight’s Relationships feature does.

Imagine one of your clients has two completely separate business units with a different set of stakeholders and desired outcomes. Here are some of the most important metrics and features you will want to consider tracking and managing separately for each BU, which can be done with Relationships:

- Success Plans: Each BU will have its own unique objectives and success criteria

- Timeline: To avoid mixing up which meetings/calls were held with which BU, you will want to have separate Timeline views

- Product Usage: Just because overall usage for the client as a whole may be strong, it is possible that one of the BUs is struggling; it’s important to be able to see product usage separately in order to coach these clients back to health

- Scorecards: Certain scorecard measures may matter more for one BU than for another; Relationships allows you to see scorecard measures for that specific BU only, as well as customize what you see for a given BU so you can block out the noise

Tactically, once Relationships is configured, CSMs can navigate to the “Relationships” section of the C360 to view the various Relationships within an account (shown below as “cards”). We recommend placing the following overview information in these cards:

- Key contact / exec sponsor

- Lifecycle Stage

- ARR

- CSM

- NPS

Figure 12: Relationship Overview Card

Finally, it is possible to port in contacts directly from SFDC to populate the contacts within each of your Relationships – which makes it easy and seamless to set up and navigate.

Chapter 5

“You’re working through massive change management”

Operationalize Your Lifecycle

The lifecycle for your high-touch customer segment captures the heart of your methodology. What is your process for getting customers to value?

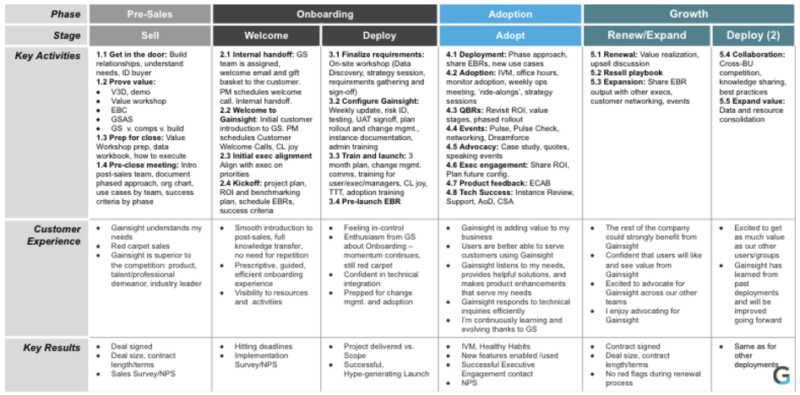

When we created our lifecycle for our Strategic clients, we spent a full day mapping out the phases and putting post-it notes for “critical moments” on the wall. We divided our client lifecycle into four distinct “Phases” with one or more “Stages” in each:

- Phase 1: Pre-Sales

- Stage(s): Sell

- Phase 2: Onboarding

- Stage(s): Welcome, Deploy

- Phase 3: Adoption

- Stages(s): Adopt

- Phase 4: Growth

- Stage(s): Renew/Expand, Deploy II

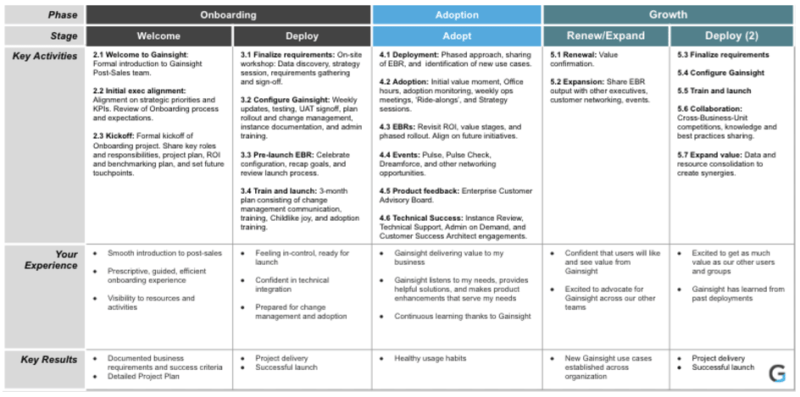

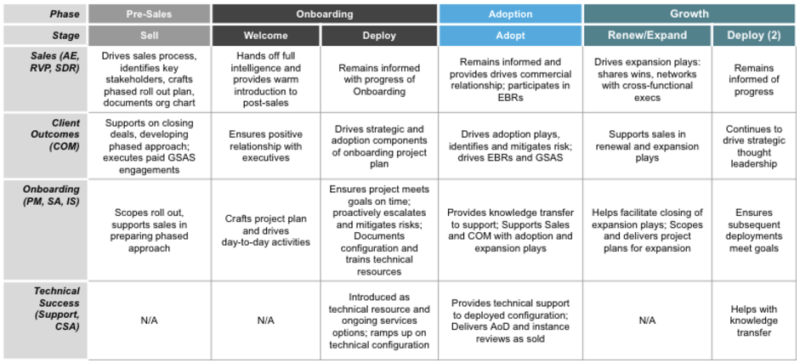

We then laid out a detailed internal playbook for each stage in the Lifecycle: exactly what activities (internal and external) would occur at each stage, what we’d like the customer experience to look like, as well as the results we expect to be achieved upon the stage completion.

Figure 13: Detailed description of Lifecycle Stages

In addition to creating this detailed playbook, we also separately created a mapping of key customer touch-points for each stage. This includes everything from the formal kick-off, initial exec alignment meeting, and onsite configuration all the way to product feedback sessions with the customer once they are fully adopting.

Figure 14: Customer Touchpoints Across the Lifecycle

Finally, we created a third mapping that defines what each of our teams internally (Sales, CSMs, Onboarding, Tech Success) are responsible for at each stage. This has been critical in order to both clearly define ownership as well as coordinate cross-functionally to deliver success throughout the customer’s lifecycle.

Figure 15: Internal Team Responsibilities by Lifecycle Stage

The aforementioned stages are what works for us, but you should come up with your own based on your product and specific customer needs. Once you’ve done so, it is critical (and relatively straightforward) to create CTAs for different activities.

Here are some of the ones we use:

- Pre-sales process CTA

- Sales handoff CTA

- EBR CTA

From here you can build out additional processes to further manage critical lifecycle events. For example, for the EBR process, we suggest building out a dashboard for tracking EBR completion, recording notes related to the EBR within Timeline, and using Email Assists to follow up before and after the EBR.

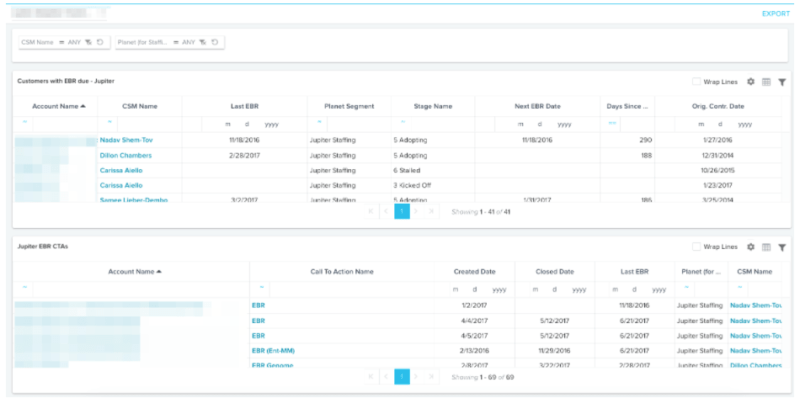

Figure 16: EBR Completion Dashboard

Finally, once one of our aforementioned CTAs closes, our CSMs create a Milestone to mark the completion of this key event. We like using Milestones for recording completion (rather than, for example, Timeline) because these are key “lifecycle” events that typically occur once or in a predetermined cadence with a customer (e.g. the handoff from Sales to Post-Sales, an EBR, etc).

Chapter 6

“Losing a CSM could be disastrous”

CSMs Record Their Notes in Timeline

In a high-touch Customer Success world, CSMs build deep long-lasting relationships with as well as collect an enormous amount of “institutional” knowledge about their customers. This could include anything from an individual stakeholder’s sentiment about your product to challenges they are having internally with change management. The CSM is a treasure trove of the most critical pieces of customer information—which poses a huge risk to your organization given that this individual could transition out of the company or into another role at a moment’s notice.

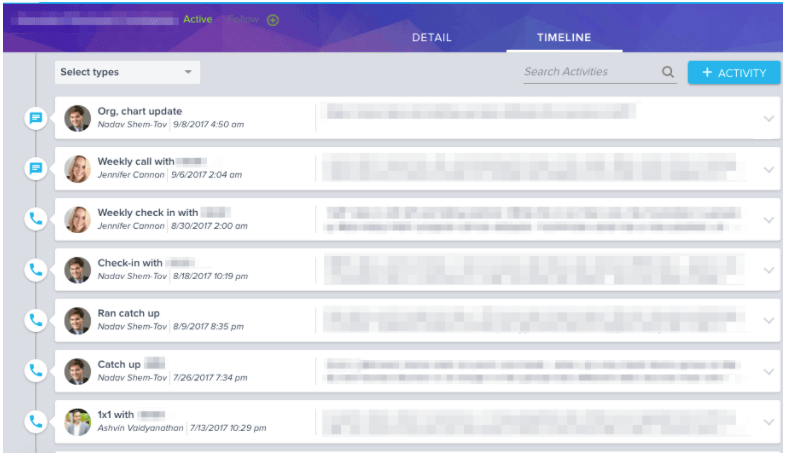

It’s therefore hugely helpful that our CSMs record all their notes from customer interactions in Timeline, which we view as the ultimate note-taking tool. Within Timeline, CSMs log key “Activities” (such as a customer meeting, an update, an email, or a call) and can write detailed notes about these interactions.

Here are some examples of situations for which a CSM should use Timeline:

- Provide an update after a customer’s EBR

- Record a critical email exchange with a customer

- Document a phone call with the customer about their strategy

Every logged Activity is preserved chronologically in the system and is easily accessible to others at Gainsight who need to be informed. Furthermore, Timeline allows the CSM to reference specific contacts in his/her notes: because Timeline is connected to our Salesforce Contacts, our CSMs can quickly find individuals, and easily update things like Contact Title, Role, and Contact Information.

We encourage our CSMs to have very strong hygiene around recording customer interactions and general customer knowledge. We recommend logging Timeline updates on a regular (i.e. weekly) cadence, and many of our customers do the same. We also trigger a CTA when a CSM hasn’t logged an update in Timeline in a while (i.e. after one week). With all of this information neatly, chronologically, and consistently documented in one centralized location, we have peace of mind that our customers will be in good hands should we need to transition them to another CSM.

Chapter 7

“Your large clients want you to own the outcome for their business”

CSMs and AEs Capture Objectives in Success Plans

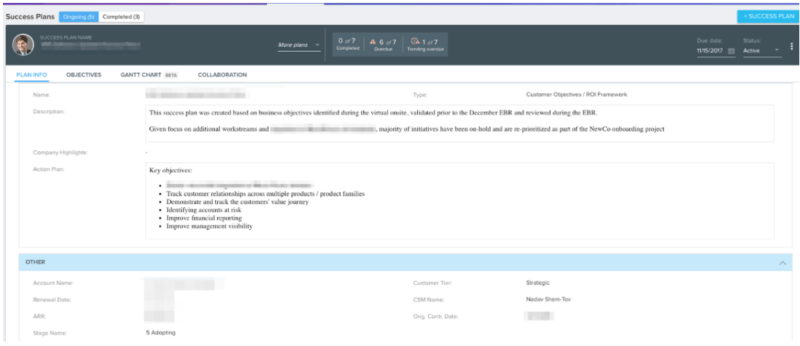

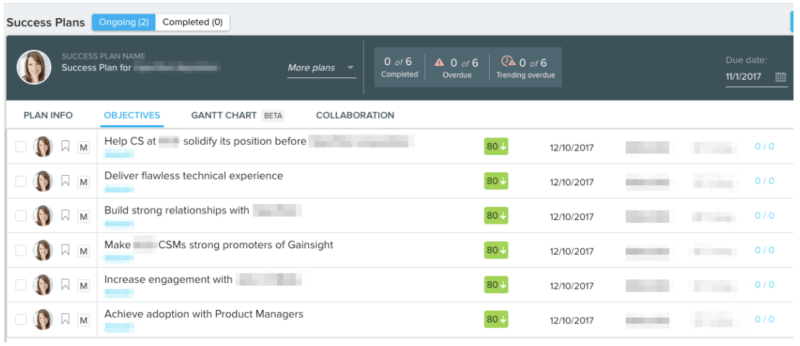

Your Sales team has Account Plans to lay out how they will expand and upsell an account. The equivalent for your CSMs is a Success Plan. A Success Plan is the CSM’s internal account plan or roadmap for how s/he plans to achieve specific objectives within a client. A Success Plan could be defined together with the client, but we also use Success Plans to internally to align on a strategy to grow the account.

We recommend starting with the following four types of Success Plans for your customers and then thinking through other use cases:

1. Customer Objectives Plan (Collaborative)

- In a Customer Objectives Plan, CSMs work closely with each of their clients to 1) define and lay out the objectives they are working on for the next quarter (or year) as well as 2) define measurable key success criteria for each of these objectives.

- It is critical to define these objectives / success criteria early in the customer’s lifecycle (i.e. capture these goals in the Success Plan as a part of pre-sales conversations with customers); the plan can then be passed on from pre-sales into onboarding and finally to the CSM.

Figure 17: Customer Objectives Plan

2. Get Well Plan (Internal)

- A Get Well Plan is an internal plan used to address those customers who have a red Overall Health Score— i.e. those customers that need to be nurtured back to health. We recommend listing out no more than 4 key objectives that need to happen in order to meaningfully improve the Overall Health Score.

- These objectives could be CSM tasks or they could be cross-functional—i.e. it could be Product needs to fix a bug or there is an open Support risk needs to be addressed. Each team can then take ownership for these tasks.

- We recommend CSMs make a draft of the plan, review with their manager, get buy in, and then use the plan to manage through with the client.

Figure 18: Get Well Plan

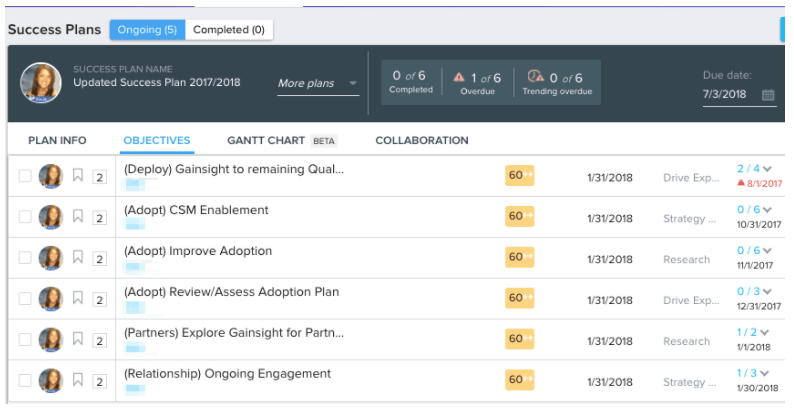

3. Adoption Plan (Internal)

- An Adoption Plan is another internal plan geared at helping CSMs record and commit to targets around driving both depth of product adoption (DAU growth) as well as breadth of product adoption (feature adoption).

- At the beginning of the quarter, CSMs should list individual objectives for each of these adoption metrics (i.e. increase DAUs by 20% or get client using X, Y, Z features by end of quarter).

Figure 19: Adoption Plan

4. Account Plan

- An Account Plan is an Internal collaborative plan between CSMs and Sales Reps with the goal of thinking through the steps needed to generate expansion/upsell within an account as well as increase advocacy.

Figure 20: Account Plan

Chapter 8

“Your senior CSMs don’t want to do repetitive stuff”

Give Them the Gift of Email Assist

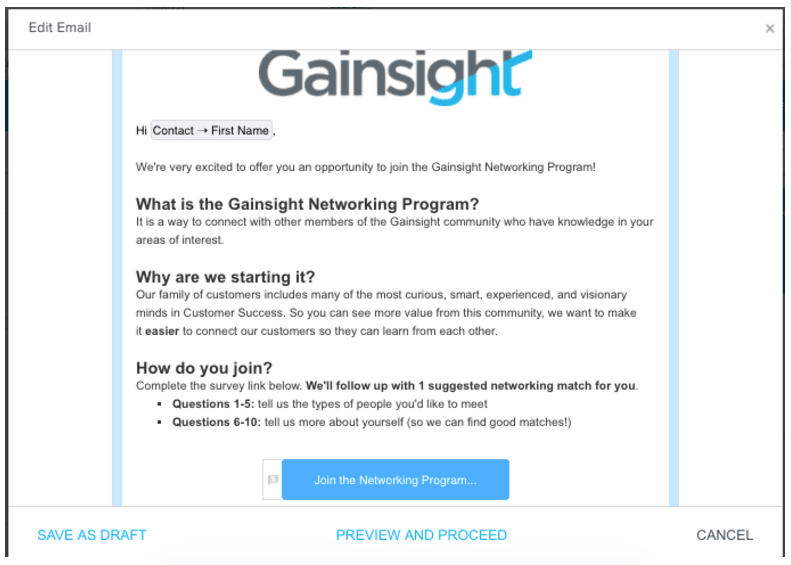

CSMs are high-leverage, strategic thinkers who want to be meeting with and helping their customers, not spending hours writing emails. But unlike in a tech touch / low touch Customer Success model, form emails (even tokenized ones) don’t work for high touch customers: these customers require a slightly more tailored message, or oftentimes the CSM wants to add a personal touch.

At the same time, CSMs need not formulate emails completely from scratch. Our CSMs use Email Assist to leverage tokenized email templates for common use cases (see below) that can then be edited and personalized. In addition to saving your CSM’s precious time, customer communications are more consistent because a standardized template is always used as a base.

Email Assists can be used in a variety of different ways; here are some of our favorite:

- Reaching out to schedule an EBR

- Responding to a specific score from an NPS survey

- Reaching out about an upcoming renewal

- Invitations to Events (e.g. configuration sessions at Pulse)

- Usage drops

- Product releases

As a general rule, think of using Email Assist for any “if this, then that” scenario, particularly because CSMs can directly send Email Assists from Playbook tasks within a CTA. For example, if a customer responds to an NPS survey with a low rating, a CTA can trigger with an associated Email Assist that allows the CSM to respond with a tailored message. Similarly, if a customer’s renewal is coming up within the next 90 days, an Email Assist can be sent with auto-populated customer data points (e.g. the customer’s renewal date).

Keep an eye out for even more Email Assist functionality down the line: CSMs will soon be able to embed surveys and reports directly within the Email Assist.

Chapter 9

“If you’re not growing, you’re shrinking”

Continually Drive Expansion in Your Large Clients

Our CSMs are always searching for ways to drive upsell and expansion into new BUs or other functions (i.e. Sales) within our largest customers. The keys to not missing an expansion opportunity within an existing customer are 1) ensuring that CSMs and AEs/CAMs are communicating regularly and working collaboratively and 2) providing them with clear indicators that a customer is ripe for expansion, including suggestions for specific opportunities.

For (1), we recommend creating a jointly owned Account Plan that CSMs and Sales Reps create together (we discussed this already in tip #6). This is a great first step in making sure your CSMs and Sales Reps are always on the same page, have aligned on expansion goals, and are reaching out to the right role at the right time within the customer.

For (2), we have a few different ways of “flagging” that a customer could be a good candidate for an expansion opportunity. Some of these include:

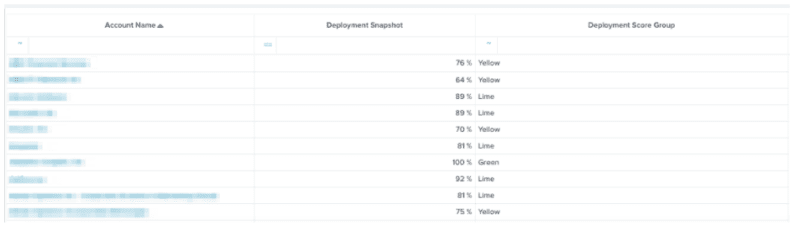

Deployment Scorecard

One of the most useful scorecards we have to alert our CSMs of whether there is an opportunity for upsell (or conversely a product usage risk) is our Deployment Score. We obviously consider a high deployment number a strong indicator that a customer is in need of more licenses, or potentially even licenses for customers in new functions (i.e. Sales or Marketing). Our CSMs regularly take a look at a list of their customers and Deployment scores, which we have also mapped to “Green” through “Red” indicators. For customers in “Green,” our CSMs will proactively reach out regarding expansion. For those in “Red” or “Orange,” the CSM will launch other efforts in order to deploy undeployed licenses in a systematic way.

Figure 21: Deployment Report by Account

Product Whitespace Dashboard

One of the most critical pieces of information for a CSM or Rep to know when trying to upsell a customer is understanding what they have already bought from you. The difference between what they already have and the full set of SKUs they could buy is what we call the product whitespace. This is essentially a list of all of the potential products a customer could buy from you but hasn’t yet taken advantage of. Armed with this information, a CSM can start having strategic conversations with a customer long before renewal time in order to guide them in the direction of purchasing new SKUs. We recommend porting this information into a dashboard within Gainsight so it is always on hand to the CSM and Rep.

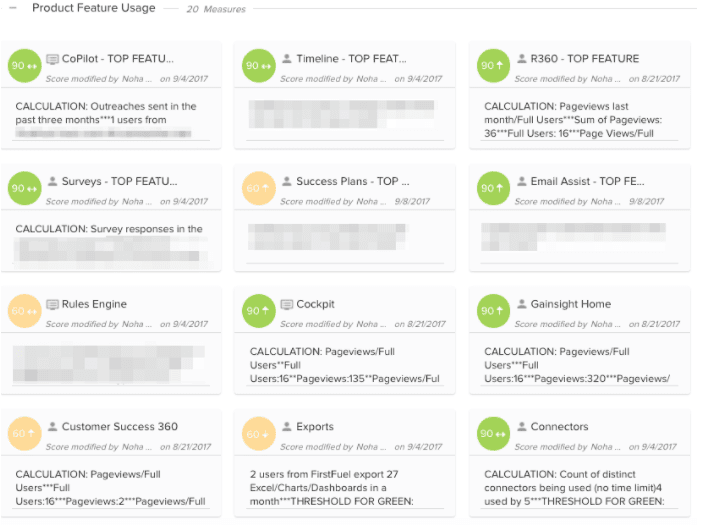

Feature Usage

For our own customers, we track usage of our “stickiest” features—those that we know are highly correlated with strong adoption and retention. We do this by creating scorecards for individual features (with metrics like “monthly pageviews / full users”) based off of usage data. We can then track, on a weekly basis, how strongly a given customer is using a feature and how they are trending towards better feature adoption. A customer that is in “Green” (strong usage) across five or more of the seven features we track is considered a strong, healthy user of our product.

Our CSMs live in this feature data as it allows them the visibility into where customers are struggling with the product and gives them the tools to have very structured, focused customer conversations about best practices and ways to drive better adoption. Conversely, for customers that are healthy users, our CSMs can confidently hold conversations about upsell or cross-sell opportunities knowing that the customer is already seeing significant value from the product. Similar to the Deployment CTA, we recommend creating a CTA that triggers when a customer moves into “healthy” usage and following up with that customer about expansion.

Figure 22: Feature Scorecards

Chapter 10

“You need to herd cats within your company”

Define Cross-Functional Processes

With Services: Define the Initial Value Moment

The official handover from your onboarding team to your CS team is a critical moment that you don’t want to get wrong. Services must make sure the customer is set up and seeing sufficient value out of the product before getting CS involved for the long-haul. We call this the “Initial Value Moment” or IVM—and we have a standardized set of criteria a customer has to meet before Services can ask the CSM team to engage.

During the Onboarding of customers, we first roll out to a pilot group of ~10% of the total licenses we intend to deploy. For example, if we are selling to a team of 200 users, we will define a pilot group of 20 to onboard first before starting the process with the others. For the CSM team to get involved, the pilot group must hit the IVM, which is defined as:

- Overall healthy product usage: Two weeks of Green usage in our Habits scorecard, which is a proxy for active product usage)

- Breadth of product usage: Two weeks of strong product feature usage of at least 5 features—we have a scorecard for this too

- Tactical graduation criteria: e.g. detailed documentation of the instance completed, a confident Admin up and running, etc

Once IVM has been hit with the pilot group, our CSM gets involved. It doesn’t mean the Services engagement is over—there are still more customers to Onboard!—it just means that we can now begin the process of handing over the relationship to CS. We recommend following a similar cross functional process to ensure there are never any dropped balls in handover!

With Product: Treat Your Clients as Partners

The most valuable product feedback comes directly from your customers. But instead of having your CSMs serve as a go-between for this feedback, we recommend actively facilitating direct two-way conversations between your company’s Product team and the customer.

Here are some ways we suggest creating these points of contact for your high-touch customers:

Customer Advisory Board (quarterly):

Organize a customer invite-only webinar where the Product team shares the upcoming product roadmap, asks directly for feedback on in-progress features as well as future areas of focus

Personalized release announcements (at release):

Send an email to announce an upcoming product release. Email Assist can be used to add a personal touch and call out specific features that will be impactful to an individual customer

Product Risk CTAs (ongoing):

Create Product Risk CTAs to capture specific product pain points or other feedback a customer may have; internally CSMs can assign this CTA to someone from the Product team who can post progress updates as well as be looped into any customer conversations if the issue is more serious

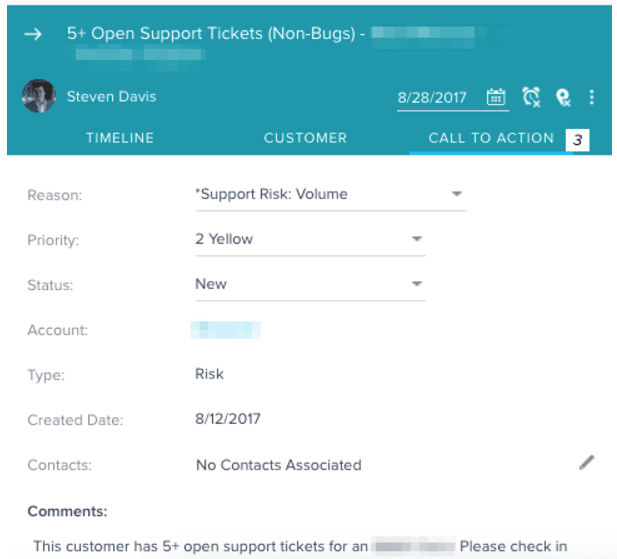

With Support: Manage Risk

Your support team is far from a siloed function. Given that Support risks can often be early signs of customer frustration, it is critical to implement a robust support risk process to get ahead of the situation and work closely with the key stakeholders internally and at the customer. Our Support Risk process specifically addresses two types of risks: Support Risks and Bug Risks. We also collaborate cross functionally with the onboarding and CSM teams on Product Risks.

Our Support team utilizes a combination of Calls to Action and Scorecards to address risks. A Support Risk CTA will trigger for a given customer in one of three situations:

- High volume of support tickets

- A ticket has been open for a long period of time

- The priority level is High or Urgent and the ticket hasn’t been resolved within a specified period of time

Figure 23: Support Risk CTA

The thresholds set to trigger the CTA will be unique for by customer and could also be unique by business unit within the customer. When setting up our thresholds, the Support team considered goals around time to resolution as well as the quality of customer experience we wanted to commit to.

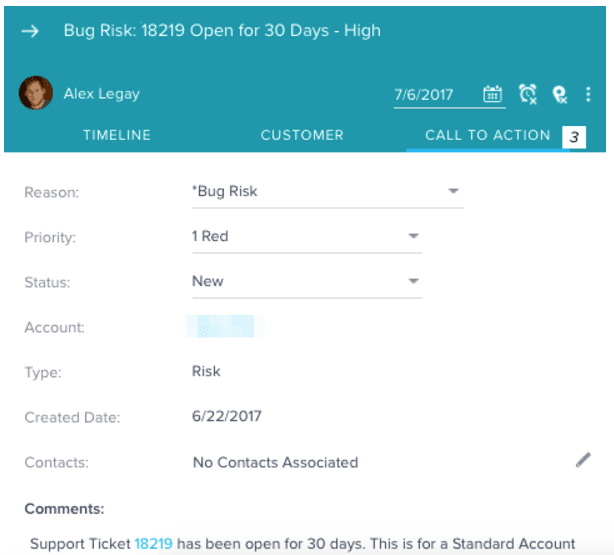

When it comes to bugs, we have rolled out a very similar process which focuses on tickets which have been classified as product bugs. A Bug Risk CTA triggers when there is one of three situations:

- High volume of bug tickets—the threshold set is dependent on the size of the customer

- High priority bug ticket has been open for over 30 days

Figure 23: Bug Risk CTA

When risks are triggered (either for Support or for Bugs), they are assigned to our respective support managers with a task in the playbook assigned to the CSM to keep them informed.

Finally, we created a Scorecard component for support and bug risk categories and linked those Scorecards to Risk CTAs. The existence of a particular Risk CTA influences the color of the corresponding scorecard.

Figure 23: Support and Bug Risk Scorecard

For more on our cross-functional Support Risk process, check out this post on Why Your Support Team Should Be Using Gainsight.

A Final Note

If you manage strategic accounts, we know you know how important it is to not miss a beat. Hopefully this post has given you a better sense of many of the processes we recommend employing to achieve best-in-class high-touch Customer Success. You likely are already implementing many of these processes in some form or fashion with your customers today, but if not, we recommend getting started ASAP!

Contact your Gainsight Client Outcomes Manager or Allison at apickens@gainsight.com.

Products

Platform

Solutions

Industries and Teams

Resources

© 2024 Gainsight, The Customer Success Company. All rights reserved. // 350 Bay Street, Suite 100, San Francisco, CA 94133 // +1 (888) 623-8562

Terms and Conditions // Privacy // Do not sell my personal information // Security