The Essential Guide to Enterprise Product Metrics

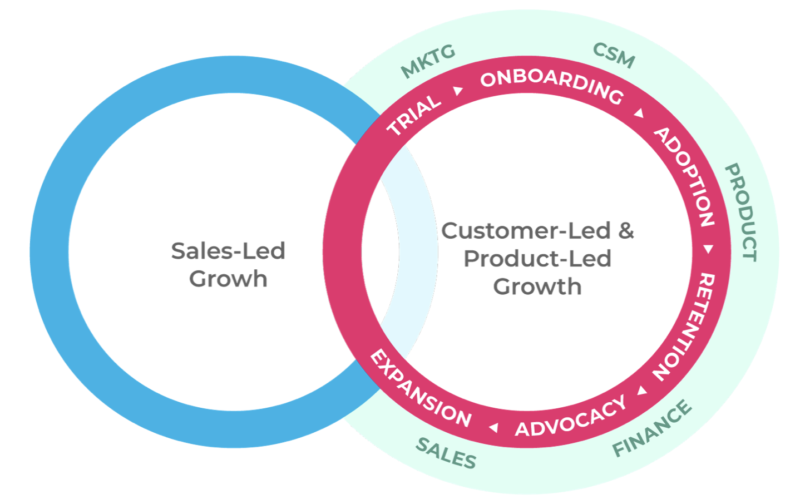

The Software-as-a-Service (SaaS) industry will be worth $720 billion by 2028 and is growing at an annual rate of 25%, covering applications such as human resources, customer relationship management, marketing, and collaboration. This growth has introduced dozens of metrics designed to measure the performance of SaaS companies and products. Investors and financial analysts increasingly rely on product experience metrics as leading indicators of a SaaS company’s economic performance.

Enterprise SaaS product metrics can be divided into three categories: product experience (PX), customer success (CS), and financial performance. The metrics in these three categories represent cause and effect. In other words, economic success can only be derived from customer success, which can’t happen without users engaging regularly with the product.

Image demonstrates the relationship between PX, CS and Financial Performance

Business-to-consumer (B2C) products focus on metrics like social engagement, shopping cart abandonment, or time to first purchase. However, those concepts are usually not applicable to business-to-business (B2B) applications that serve the enterprise market. Daily active users, adoption rate, and customer churn rate matter more for enterprise application products.

This article will provide a concise guide to the essential SaaS enterprise product metrics your business can use to plan its growth.

Enterprise Product Metrics Summary

The table below highlights product metrics that report on the health of an enterprise SaaS product, organized by category. Dozens of other metrics exist under each category; however, our focus is to help readers start with a foundation of essential metrics that investors have come to expect from a company offering software as a service.

The three categories used to organize the items presented in the table are:

- Product experience (PX)

- Customer success (CS), and

- Financial performance ($)

| Metric | Category | Description | Context |

|---|---|---|---|

| Conversion Rate (from a trial to a subscription) | PX | The number of new subscriptions divided by the total number of trials during the same period. | A product that delivers value during the trial stage sells itself. This concept is also known as Product Led Growth (PLG). |

| Daily and Monthly Active Users (DAU and MAU) | PX | The number of users meeting daily or monthly activity criteria. | Not every paying account is active. A declining long-term trend of daily activity eventually leads to service cancellation. |

| Adoption Rate | PX | The number of active users divided by the number of total signups during the same period. | The churn rate is the reverse of the adoption rate, as inactive users eventually cancel or abandon their accounts. |

| Net Promoter Score (NPS) | CS | The percentage of promoters minus the percentage of detractors (explained later in this article) | Would you recommend this product to others? It’s a simple yet insightful question and why NPS remains popular |

| Customer Retention Rate | CS | Renewals divided by total subscriptions for the same period | Financial success can only come from satisfied users who continue to renew their subscriptions |

| Monthly Recurring Revenue (MRR) | $ | A product’s monthly sales generated from its subscriptions | The annual and multi-year contracts are translated into monthly values to present this simple measure of financial performance |

| Customer Lifetime Value (LTV) | $ | The gross profits produced by an average customer over its lifetime | A customer that renews forever theoretically has infinite value. In practice, the lifetime of an average customer is determined based on the company’s retention rate |

| Customer Acquisition Costs (CAC) | $ | The total costs of sales and marketing divided by the total number of new customers acquired during that interval | A healthy SaaS business produces a customer lifetime value at least three times higher than its customer acquisition cost |

Enterprise Product Metrics Explained

The following section explains each metric in more detail in the same order presented in the summary table.

Conversion Rate

Conversion rate could describe the transition from any stage in the sales pipeline to the next. However, the traditional definition, which we will use, refers to the transition from a free trial to a paid subscription. Many SaaS vendors offer a free trial to prospective customers before incentivizing them to subscribe to a paid plan that includes advanced product features.

Conversion Rate % = (Total number of subscribers / Total number of free trial customers) x 100.

Let’s say a SaaS company signs up 400 users on its freemium plan in a month. Over the following three months, 250 users from that cohort upgraded to a paid plan. The conversion rate would be:

Conversion rate is (250 / 400) x 100 = 62.5%.

The same math is sometimes applied without tracking cohorts (groups of sign-ups within a specific month or quarter) and simply divides the total number of paid customers by the total number of current freemium account holders.

According to a survey of 450 SaaS operators conducted by OpenView Partners (a venture capital firm specializing in enterprise SaaS product investments), companies offering a free trial (for a limited time) had a 17% subscriber rate. In contrast, companies providing freemium (free forever) had an average 5% subscriber rate. However, the conversion from visitors to sign-ups was higher for the freemium model than for the limited free trial model, which intuitively makes sense.

Daily and Monthly Active Users (DAU and MAU)

A daily active user interacts with a SaaS product at least once on a given day. However, the definition of DAU may vary depending on how “activity” is defined. For example, does a user only have to log in to count as a daily user or spend more than an hour using the product? Does relying on daily notifications count as interacting with a product if the user doesn’t log in? Despite its subjective definition, DAU remains one of the most critical metrics in measuring a SaaS product’s fundamental health and value.

As a means of context, Slack has over 10 million daily active users. Slack members subscribe to a paid plan and work for 85k different companies.

Not all software applications follow a scenario that requires daily usage. Some applications, like accounting software, have loyal customers who may only log in a few times a month. Measuring active users over a more coarse time interval, such as a month, is often a more appropriate indicator of product adoption. Monthly Active User (MAU) typically complements DAU to report a software product’s uptake.

Adoption Rate

Adoption rate for a SaaS product is the number of active users divided by the number of signups during the same interval. Suppose a marketing program produced 100 registrations, of which 75 activated their accounts (took steps to input required data, making the product fully functional), and only 60 continued logging into their free accounts for the remainder of the free trial period. In this scenario:

Adoption Rate = (Number of active users, which is 60, divided by the number of signups during the same period, which is 100) x 100 = 60%

A more refined measurement of the adoption rate is the feature adoption rate. For example, an analytics product may have a live dashboard and a set of emailed reports. The live dashboard shows the real-time analytics results, while the emailed reports share historical insights.

In our example, the adoption rate of the dashboard is 100% since all users see a default dashboard upon logging in. In contrast, only 20% of the users take advantage of the emailed reports since it requires navigating to another product area and configuring various parameters.

Sophisticated SaaS product managers engage end-users in the product’s user interface as they navigate, guide them through navigation options, promote new features, and solicit in-app feedback to understand why adoption may be lacking.

|

Platform

|

Out-of-the-Box KPIs

|

Segmentation

|

Feature-Level Adoption & Retention Analysis

|

Cross-Channel User Engagements

|

Engagement Impact Analysis

|

A.I-Powered Product Feature Mapping

|

Mobile Application Support

|

|---|---|---|---|---|---|---|---|

|

Gainsight

|

✔

|

✔

|

✔

|

✔

|

✔

|

✔

|

✔

|

|

Heap

|

✔

|

✔

|

✔

|

✔

|

|||

|

Pendo

|

✔

|

✔

|

Net Promoter Score (NPS)

The concept of NPS has been around since 2001 and is now the most popular measure of customer success amongst hosted enterprise software businesses.

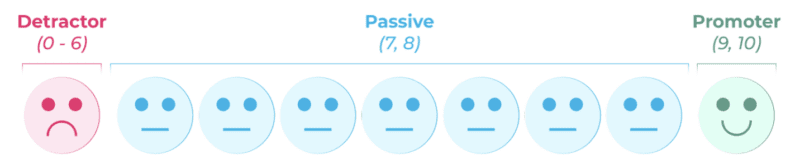

NPS asks users (usually via an on-screen pop-up) how likely they are to recommend a product to a friend or colleague using a score of 0 to 10. Responses are organized into three groups:

- the detractors (scores of 0 to 6)

- the passives (scores of 7 and 8)

- the promoters (scores of 9 and 10)

Image shows that NPS = % of promoters – % of detractors

NPS then calculates each group as a percentage of the total respondents and subtracts the percentage of detractors from the percentage of promoters.

For example, if 30% of respondents are promoters, 60% are passives, and 10% are detractors, then the NPS score is:

30 – 10 = 20

According to Satmetrix, the average NPS score for software applications is 31.

Customer Retention Rate

Customer retention rate calculates the ratio of customers who renew their plan as a percentage of total paying customers. The renewal may be monthly or annual, depending on the subscription plan. The corresponding Customer Retention Rate (CRR) is calculated as follows:

Customer Retention Rate % = (Number of customers at the end of the period – Number of customers acquired during the period) / Number of customers at the start of period x 100

If an enterprise has 125 customers at the start of January and 120 customers renew their monthly plan at the end of January, then:

CRR is 120 / 125 x 100 = 96% for January.

To maximize this rate, enterprises can plan their product roadmap by measuring feature adoption, conducting competitive gap analysis, interviewing end users, adjusting their pricing strategy, and providing better customer service.

The Customer Churn Rate (CCR) metric is utilized to measure cancellations and is the inverse of CRR. It is calculated by the percentage of customers who cancel their subscriptions.

Customer Churn Rate % = (Churned customers / Total customers) x 100

Here are some considerations to keep in mind when calculating CRR and CCR:

- Some companies calculate churn rates based on revenue instead of customer count, which yields different results. For example, if you have ten customers but two represent 80% of the revenue, the loss of a small client will not impact the churn rate calculation

- The formula we shared above is considered gross churn. Companies often report on net (vs. gross) churn, including upsell and expansion revenue

- SaaS companies often remove involuntary cancellations from their churn rate. An involuntary churn happens when a subscription ends because the credit card on file is no longer valid and not because of dissatisfaction

Monthly Recurring Revenue

All the other metrics increase revenue by gaining new paying customers or renewing and expanding existing contracts. The monthly recurring revenue (MRR) is how the industry measures SaaS revenues.

Monthly Recurring Revenue $ = Average monthly revenue per customer x Number of paying customers.

For instance, if a SaaS enterprise has five customers subscribed at a monthly average of $20 per customer and ten customers at a monthly average of $30 per customer, the calculation would be:

MRR = (5 x $20) + (10 x $30) = $400.

This metric is also the foundation for other important SaaS metrics, such as Average Revenue Per Customer (ARPC) and MRR Growth Rate.

The ARPC metric provides insight into the average revenue that a customer brings. Using the case above, the ARPC is:

MRR / Number of paying customers = $400 / 15 customers = $26.66 per customer.

The MRR Growth Rate measures how fast the recurring revenue increases due to new subscriptions, add-ons, freemium upgrades, and reactivations.

Net MRR Growth Rate % = (Net MRR at the end of the current month – Net MRR at the end of last month) / Net MRR at the end of reporting month x 100.

As means of context, according to a 2021 survey of over 350 private SaaS companies conducted by KeyBanc, the median MRR was $708k, and the average expected growth was 36%.

Customer Lifetime Value

Every SaaS company wants to know how much revenue a new customer will bring over time. The customer Lifetime Value (LTV or CLV or CLTV) metric determines the total worth of this customer to the company.

Customer Lifetime Value $ = Average revenue per customer x Customer average lifetime.

The average customer lifetime is the time between a customer’s first and last purchase. If the ARPC is $25 and the average lifetime of a paying customer is 20 months, then the CLTV is $500.

It’s worth noting that one can also use the churn rate to calculate the average lifetime of a customer. For example, a monthly churn rate of 5% would mean that a pool of 100 clients would diminish to zero over 20 months as five customers terminate their membership each month.

Financial enterprise product metrics aren’t supervised by a governing body such as the Financial Accounting Standards Board (FASB), which issues rules to audit financial statements. This lack of central oversight leaves a degree of subjectivity in how different companies calculate their SaaS financial metrics.

For example, even though some companies define LTV using revenues as we did above, more rigorous investors require companies to calculate the customer lifetime value (CLV or LTV) using gross profit rather than revenue.

Gross profits are equal to the revenues minus the cost of sales (CoS), which are the direct costs associated with operating the software platform, such as the costs of hosting the product platform and supporting the customers. The rationale for using gross profit is that you can’t produce revenues without the direct variable costs, so the actual financial value of a customer to the company is the gross profit, not the revenue. The direct expenses (a.k.a. cost of service) for a healthy SaaS operation typically range from 15 to 30% of revenue.

Customer Acquisition Cost

Another crucial SaaS metric is Customer Acquisition Cost (CAC). CAC determines the average amount of money spent to acquire a new customer.

Customer Acquisition Cost $ = Total sales and marketing costs / Total number of customers acquired.

Imagine an enterprise spending $10,000 monthly on sales and marketing and acquiring 100 new customers.

The CAC is $10,000 / 100 = $100.

This cost is usually associated with marketing and sales engagements, although this can be deceptively subjective to calculate. For example, your account team may support promising prospects during the free trial stage (pre-sales) and continue supporting them once they subscribe to a paid plan (post-sales).

In this scenario, the CAC calculation should only include the portion of their salary covering the time spent during the pre-sales stage of the engagement. Another complexity is the need to allocate office rent by sales employees to capture the total cost of sales.

SaaS companies aim to keep CAC low and recover the cost through recurring revenue that customers bring over their lifetime within 12 months. A rule of thumb is that the LTV should be approximately three times the CAC (referred to as LTV to CAC ratio).

Goal: LTV / CAC = 3

Best Practices for Adopting Product Metrics

Be Stage-appropriate

Select metrics appropriate for your company’s stage. For example, the MRR growth rate is not always suitable for early startups as their revenues start from zero, and growth percentages are 100% or more within the first few months. More relevant metrics would be the rate of sign-ups and the users’ engagement with features inside a new product.

Invest in Leading Indicators

The behavior of users within a product can often determine their renewal rate. Users are more likely to cancel if they begin to log in less frequently, stay for shorter periods, or don’t adopt key features. Include user behavior instrumentation on your list of product requirements early in your planning process and track your product’s adoption rate as soon as you have active users.

Follow the User Journey

Users go through different stages during their product journey, and you must track the right metrics at each stage. For example, measuring activation and feature adoption during a user’s early days is essential. In contrast, metrics such as net promoter score and renewal rate are more meaningful in later stages.

Align with Business Priorities

A “North Star” is a metric or a set of metrics that measures a high-priority aspect of your business. Choosing a North Star helps drive an organization-wide focus on the right areas. For example, a company that lacks renewals should focus on churn rate and feature adoption metrics. The North Star metric should change as the business challenges, priorities, and strategies evolve over time.

Experiment Before Adopting

Avoid paralysis by analysis when selecting the best product metrics. Measuring and selecting metrics requires staffing, instrumentation, processes, resources, and time. It’s more beneficial to have the right metrics rather than every metric.

Don’t Forget Anecdotal Feedback

Use a mix of quantitative metrics and qualitative feedback to drive strategy. No metric can replace the value of a conversation with a customer.

A practical method for soliciting end-user feedback is engaging them in the application user interface. For example, a product manager may add an open-text field as part of a survey into the user interface, seeking feedback on a recently-launched feature.

Be Transparent

Enterprise product metrics should be up to date, transparent, and accessible throughout the organization. By doing so, each department can independently plan their contribution to the product’s success. Management expert Peter Druker summarizes this with the quote: “[only] what gets measured, gets managed.”

Conclusion

Measuring the performance of a SaaS company starts with gathering the essential metrics that describe a user’s journey end-to-end, from free trial to product usage and customer success. Analyzing the results and implementing appropriate changes will enable a savvy business to increase customer renewals and recurring revenues. To recap, the crucial metrics to capture are:

- Conversion Rate (from trial to a subscription)

- Daily and Monthly Active Users (DAU and MAU)

- Adoption Rate

- Net Promoter Score (NPS)

- Customer Retention

- Monthly Recurring Revenue (MRR)

- Customer Lifetime Value (LTV)

- Customer Acquisition Costs (CAC)

Companies that understand the importance of leading indicators recognize that product instrumentation is just as vital to success as the product itself.